April 2025

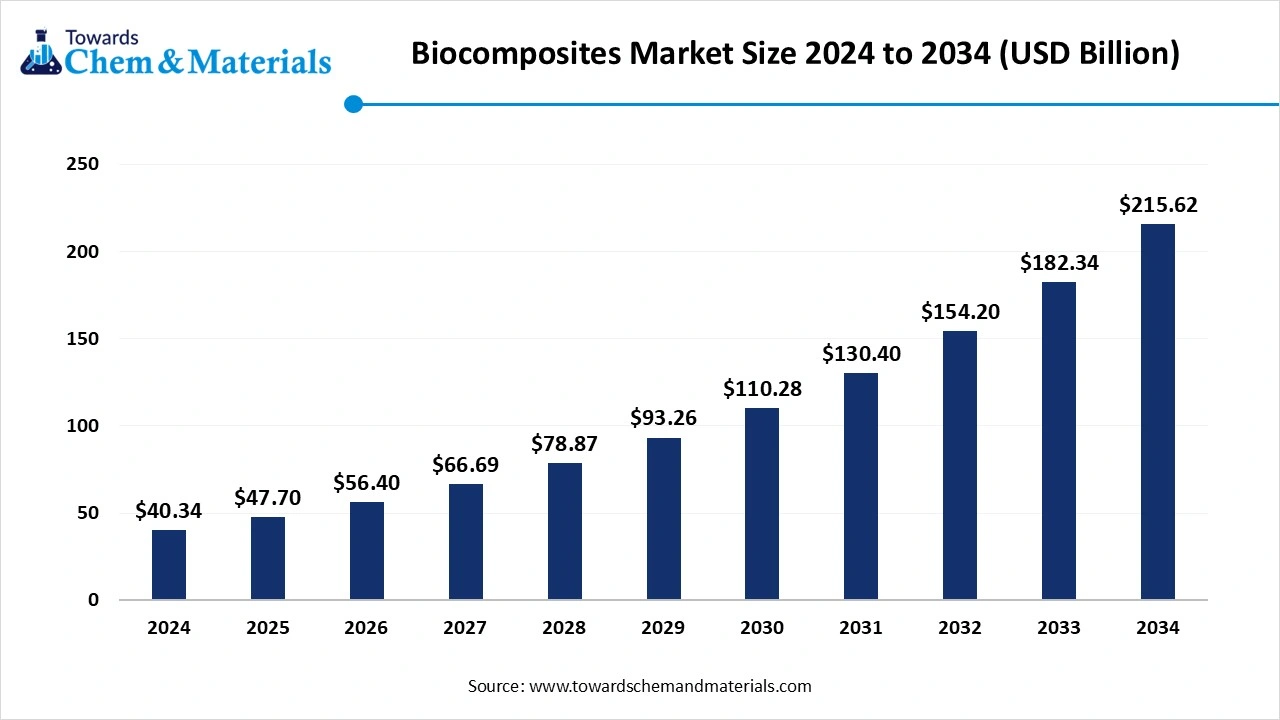

The global biocomposites market size was valued at USD 40.34 billion in 2024 and is estimated to hit around USD 215.62 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 18.25% during the forecast period 2025 to 2034. the technological breakthroughs and eco-driven actions are expected to create lucrative opportunities in the growth of biocomposites market.

The biocomposites market has seen a steady growth rate throughout the past period. These composites are made of natural resources such as hemp, jute, and flax which are biodegradable and have strong durability. Rising environmental pollution and the promotion of governmental initiatives towards sustainability are expected to lead to market growth in the coming years. By developing more advanced biocomposites than other composites, manufacturers can increase their market weight in the coming period.

Technological advancement has been driving market growth in recent years. modern advancements are developing bio-based raisins which improve the durability and performance of biocomposites. This development can eliminate previous challenges such as low moisture resistance and limited strength. These bio-based resins are made up of sources such as corn, soy, and vegetable oil. Moreover, biocomposites producers are investing in R&D activities by exploring the latest technologies such as nanotechnology and others.

Rising sustainable construction and infrastructure development practices are projected to create significant opportunities for the biocomposites market in the coming years. As individuals are turning towards modern and environment-friendly construction development for better comfort and material strength. Biocomposites are heavily used in modern construction applications such as insulation, decking, wall panels, and roofing. Moreover, green building initiatives are expected to gain a major market share during the forecast period.

Limited mechanical performance and durability are anticipated to hamper market growth during the forecast period. Biocomposites have limited mechanical performance and durability compared to traditional synthetic composites. Moreover, low moisture absorption sensitivity can hinder biocomposites sales in the future as these biocomposites are less suitable for outdoor applications. Lower impact resistance is another factor that can restrict market progression in the coming years.

Asia Pacific dominated the biocomposites market in 2024. The growth of the market is attributed to the rising population and the industrialization which boosts the demand for sustainable material and with the presence of the larger manufacturing bases collectively leading the demand for the market in the region. Countries such as India, China, and Japan are playing a major role in the production and consumption of biocomposites. Moreover, favorable government initiatives towards biocomposites are creating attractive market

China held a leading position in the Asia Pacific region due to its strong industrial infrastructure and a high rate of eco-friendly material export in recent years. Furthermore, the automotive, packaging, and construction industries are heavily contributing to the sales of biocomposites in China nowadays. China has huge natural resources such as hemp, flax, and jute which allows biocomposites manufacturers to produce biocomposites at a lower

For Instance,

North America is projected to capture a significant market share of the biocomposites market during the forecast period. The growth of the market is attributed to the growing technological advantages and supportive government policies. The government policies towards reducing carbon emissions are expected to increase demand for biocomposites in the region for future periods. The advanced technological capacities such as advances in material sciences are likely to make a major impact on the market in the region.

United States is anticipated to make a strong foothold in the biocomposites market in the North America region. The expansion of the automotive manufacturing industry is projected to lead to market growth in the country. As biocomposites are used majorly in vehicle production due to the improvisation of fuel efficacy while reducing vehicle weight. Manufacturers are increasingly investing in research and development programs to make lightweight and strong biocomposites to gain industrial attention in recent years.

Wood fiber composites segment dominated the biocomposites market in 2024. By offering sustainability and durability, wood fiber gained popularity among individuals. Factors such as cost efficacy and maximum benefits are expected to help segment growth in future periods. Also, wood fibers can reduce dependency on limited resources while managing

Non-wood fiber composite segment is anticipated to make a strong foothold in the coming years. Having a high strength-to-weight ratio and excellence for weight-sensitive industries is expected to contribute majorly to segment growth. The expansion of the aerospace industry is projected to hold an important share of segment progress during the forecasted period.

Green biocomposites segment maintained its dominance in the biocomposites market in 2024. The growth of the segment is due to increased favorable government initiatives toward sustainability standards and a green environment. Consumers are heavily demanding biodegradable products with increased awareness of environmental issues.

The hybrid biocomposites segment is expected to gain major market attraction in forecast period. Hybrid products are mainly used in construction industries in recent years. With factors such as the ability to withstand harsh weather conditions and structural stress

Synthetic polymer segment dominated the market in 2024. The growth of the segment is owing to the advantages such as versatility, durability, and superior strength qualities. Synthetic polymers include polypropylene, polyethylene, and polyvinyl chloride which can offer excellent resistance and mechanical properties to environmental factors such as temperature changes and moisture.

The natural polymer is expected to make a huge impact in the biocomposites market in the coming years. The rising demand for sustainable and eco-friendly products is likely to drive the segment growth in the future. The biodegradability is the most important factor that is expected to increase future sales of natural polymers in the projected period. as natural polymers cannot take a long period to decompose compared to synthetic polymers. It can be easily broken down and helps to maintain the environment and sustainability.

The transportation segment dominated the biocomposites market in 2024. The need for lightweight materials with high performance has been driving segment growth in recent years. Biocomposites can maintain fuel efficiency during transportation. Thus, lighter vehicles are consuming less fuel by reducing operational costs and carbon emissions.

The building and construction segment expects significant growth in the market during the predicted period. The rise in the green building initiatives and in the current scenario, certifications like LEED (leadership in energy and environmental design) are turning construction industries towards the usage of eco-friendly materials in the construction process. These initiatives are likely to heighten segment growth during the forecast period.

By Fiber Type

By Polymer Type

By Product

By Process Type

By End User

By Geography

April 2025

April 2025

April 2025

April 2025