April 2025

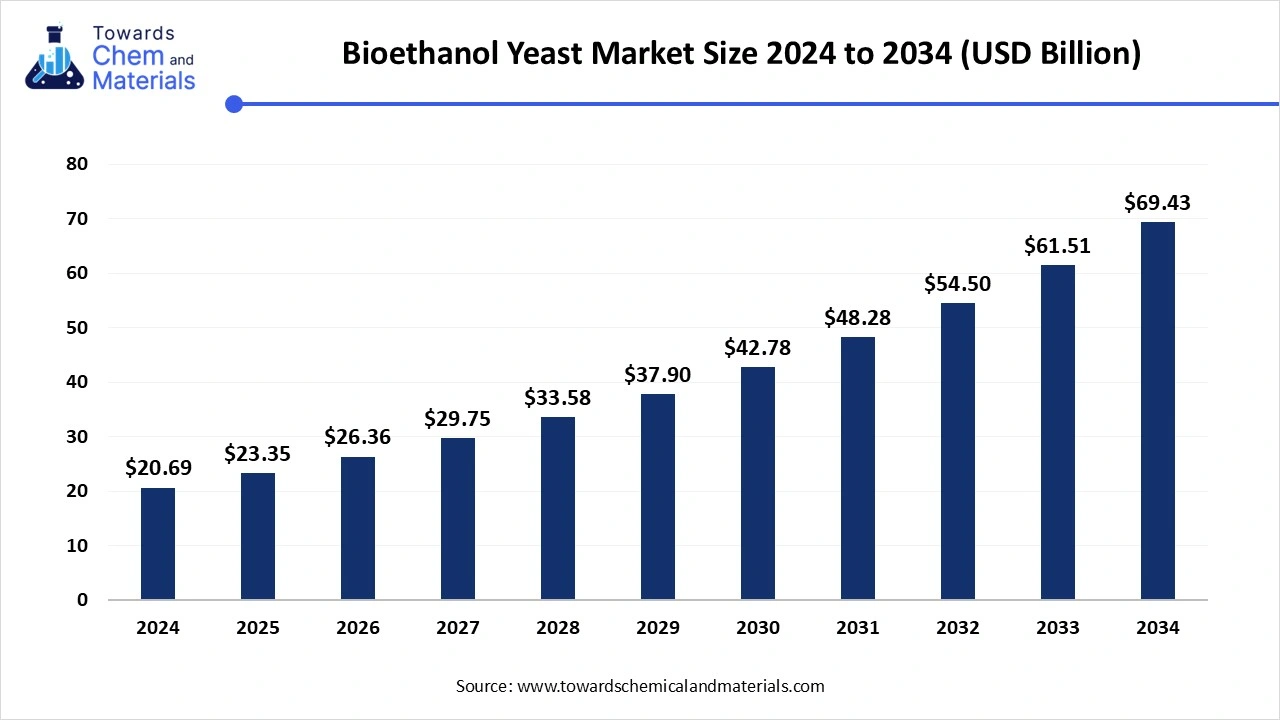

The global bioethanol yeast market size is estimated at USD 20.69 billion in 2024, is projected to grow to USD 23.35 billion in 2025, and is expected to reach approximately USD 69.43 billion by 2034. the market is projected to expand at a compound annual growth rate (CAGR) of 12.87% between 2025 and 2034. the rising demand for renewable energy sources and innovative advancements in the fermentation process drives the growth of the market.

Bioethanol yeast ferments sugar and converts it into ethanol. Bioethanol yeast provides various benefits such as robust fermentation, ease of genetic manipulation, and a sustainable source of energy. Saccharomyces cerevisiae is the most widely used yeast in the industrial sector. The bioethanol yeast market is growing due to the growing environmental concerns and increasing demand for renewable energy sources. Globally governments are implementing rules and regulations to promote the usage of biofuel that increases demand for bioethanol yeast.

Consumers are shifting towards sustainable energy choices that drive the growth for bioethanol which is the best alternative to fossil fuels. Countries are focusing on reducing the usage of fossil fuels due to rising environmental concerns that increase demand for renewable energy sources. Worldwide focus on lowering carbon and greenhouse gas emissions propels bioethanol market growth. Governments implement various rules and regulations to enhance the use of renewable energy sources. It is an environment-friendly choice. Shifting towards renewable energy sources decreases the usage of fossil fuels. Bioethanol manufactured through sugar fermentation, is an important part of environment-friendly energy production. The rising demand for renewable energy sources fuels the growth of the market.

| Report Attribute | Details |

| Market size value in 2025 | USD 23.35 billion |

| Revenue forecast in 2034 | USD 69.43 billion |

| Growth Rate | CAGR of 12.87% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | Type, form,application,feedstock,genus, regional |

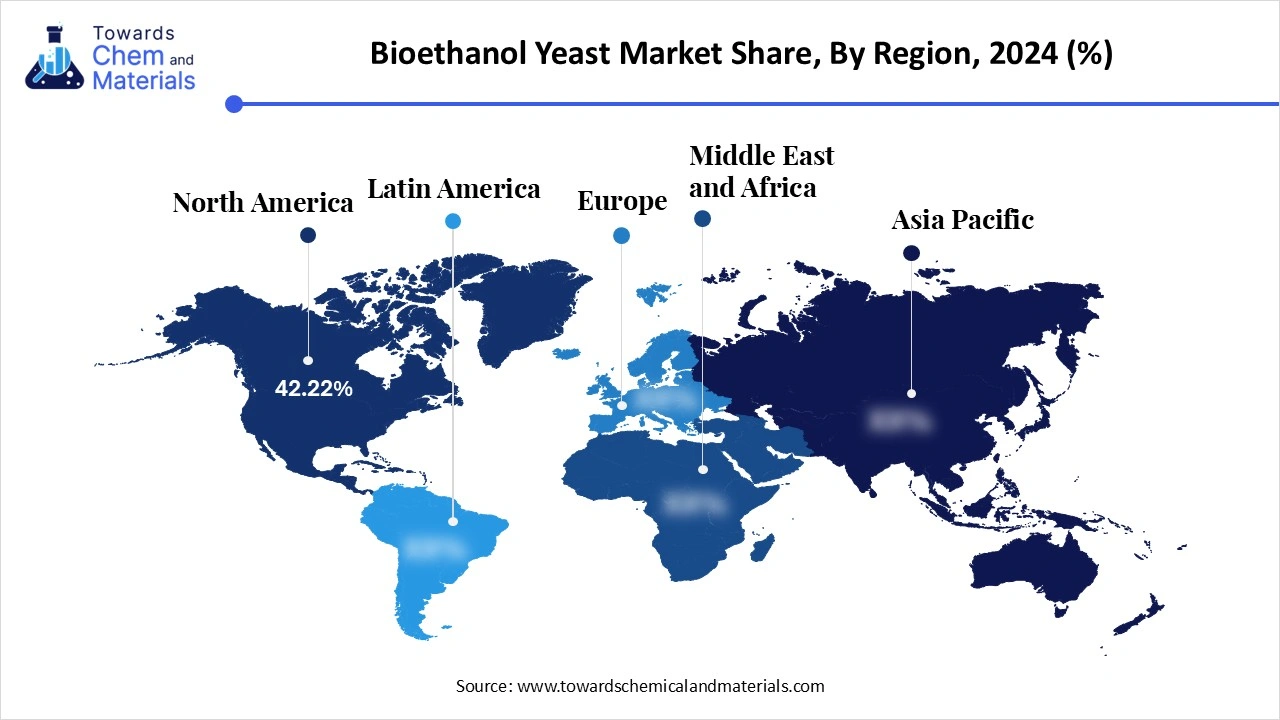

| Dominant Regional | Northa America |

| Key companies profiled | Novozymes; Associated British Foods plc; DSM; AB Mauri; Cargill, Inc.; AngelYeast Co., Ltd.; LALLEMAND Inc.; Leiber GmbH; Lesaffre; Foodchem International Corporation; Omega Yeast Labs, LLC.; Pacific Ethanol, Inc.; Oriental Yeast Co., Ltd. |

Technological advancement creates wide opportunities in the production of bioethanol yeast. Genetic engineering technology creates more efficient yeast strains and enhances tolerance of ethanol. The advanced fermentation techniques improve ethanol yield production. Technologies are working on developing a process to convert lignocellulosic biomass into ethanol. Advancements help to produce higher ethanol yields and coverts a wider range of sugar and starch into ethanol. In the manufacturing process combination of different varieties of yeast strains utilizes hexose and pentose sugar that raises ethanol production. Technological innovations reduce the cost of production and will increase the adaption of bioethanol fuel.

With several advantages related to bioethanol yeast, the fluctuating cost of feedstocks hampers the growth of the market. Feedstock prices fluctuate due to factors such as climate change, changing demand, supply chain disruptions, and agricultural policies. Higher prices of raw materials like corn and sugarcane affect the production of bioethanol yeast. The rising demand for biofuels leads to higher prices of feedstock. The availability of cheaper alternatives lowers the demand for the original feedstock, which hampers the growth of the market. The fluctuations in feedstock prices lower the demand for bioethanol yeast and that is a major restraining factor for market growth.

North America dominated the bioethanol yeast market in 2024. The rising consumer demand for eco-friendly sustainable products and government initiatives to promote biofuels drive the growth of the market in the region. The higher presence of the established agricultural industry supplies feedstocks that help in the production of bioethanol. The rapid technological advancement in yeast fermentation propels the growth of bioethanol yeast in the region. The heavier presence of the leading market players in the regional countries like the United States, and Canada is further accelerating the growth of the market in the region.

The U.S. holds the largest share of the bioethanol yeast market in the United States. The rising innovations in the food industry and advanced technology usage drive the growth of the market in the country. The U.S. has a higher number of ethanol plants. Rising consumer demand for sustainable fuels and the automotive industry's preference for cleaner energy sources propels the growth of the market.

Asia Pacific expected the significant growth in the bioethanol yeast market during the forecast period. The market witnesses the fastest growth due to increased population and rapid industrialization in the region. Rising demand for energy increases the need for alternative fuel sources such as biofuel. Furthermore, the growing civilization in the region drives demand for processed and convenience food which increases the need for yeast.

China and India are working towards reducing dependence on fossil fuels. China is focusing on research and development to build efficient yeast strains. Chinese government regulations encourage renewable energy sources and biofuels.

The baker yeast segment dominated the bioethanol yeast market in 2024. The rising demand from the food and beverage industry fuels the growth of the market. It is a cost-effective and famous option to produce ethanol. The rising demand for bakery products helps in market growth. Microorganism saccharomyces cerevisiae helps in sugar fermentation and converts it to ethanol. It is used in winemaking, brewing, and food additives drives the growth of the market. In 2023, the US department of energy stated the importance of the production of bioethanol under renewable fuel standard regulation of blending biofuels into transportation fuel in an annual congress report. Whereas the brewer's yeast segment is anticipated to be fastest growing segment during the forecast period.

The various advantages of brewer’s yeast such as maintaining healthy skin, eyes, hair, and mouth. The rising usage of brewer’s yeast in beer brewing, dietary supplements, and as a food additive drives the growth of the market. It easily converts second-generation bioethanol feedstocks into bioethanol. Additionally, innovations in fermentation technologies and rising demand for unique tastes propel the growth of the market.

The fresh yeast dominated the bioethanol yeast market in 2024. The rising consumer demand for fresh and natural ingredients in the food and beverage sector drives the growth of the market. Fresh yeast possesses superior leavening properties and high viability. Fresh yeast's ability to ferment sugar into ethanol drives the market growth. Whereas the active yeast is expecting a significant growth in the market during the forecast period. The growing demand for renewable energy and increased consumption of bakery products and alcoholic beverages fuels the growth of the market. The rising focus on lowering carbon emissions and the adoption of sustainability demand bioethanol, which fuels the market growth.

The biofuel segment dominated the bioethanol yeast market in 2024. Government policies promote the adoption of biofuel and the rising demand for renewable energy sources are major factors for the growth of the market. The growing demand for renewable energy sources to lower greenhouse gas emissions. It is an alternative to fossil fuels and is used in industries like transportation, heating, and electricity generation. Rising environmental concerns such as climate change focus on sustainable energy sources that drive demand for biofuel production. Whereas cleaning and disinfection segment are expecting the fastest growth during the forecast period.

The process of yeast fermentation produces bioethanol that is used as an eco-friendly cleaning agent. Rising demand for hygiene and sanitation products drives the growth of the market. Bioethanol has disinfectant and solvent-like properties that help in manufacturing cleaning products that are used as cleaning solutions.

The corn-based bioethanol yeast segment dominated the bioethanol yeast market in 2024. Corn consists of high starch, and it is cost-effective which drives the growth of the market. Extraction and fermentation of sugar from corn is easy and it produces large amounts of ethanol. Whereas the sugarcane segment is expected the significant growth during the forecast period. The high sugar content and easy extraction process drive the growth of the market. Sugarcane is widely cultivated in various regions, and it reduces the greenhouse gas emission.

Saccharomyces segment dominated the bioethanol yeast market in 2024. The high ethanol production quality and fermentation of a wide range of sugars propels the growth of the market. It consists of the ability to sustain in a high-ethanol concentration environment. Whereas Kluyveromyces segment is expecting the substantial growth in the market during the forecast period. The higher tolerance and rapid rate of growth drive market expansion. It is widely used in the dairy industry, and it helps to metabolize different sugars like lignocellulosic biomass.

April 2025

April 2025

April 2025

April 2025