April 2025

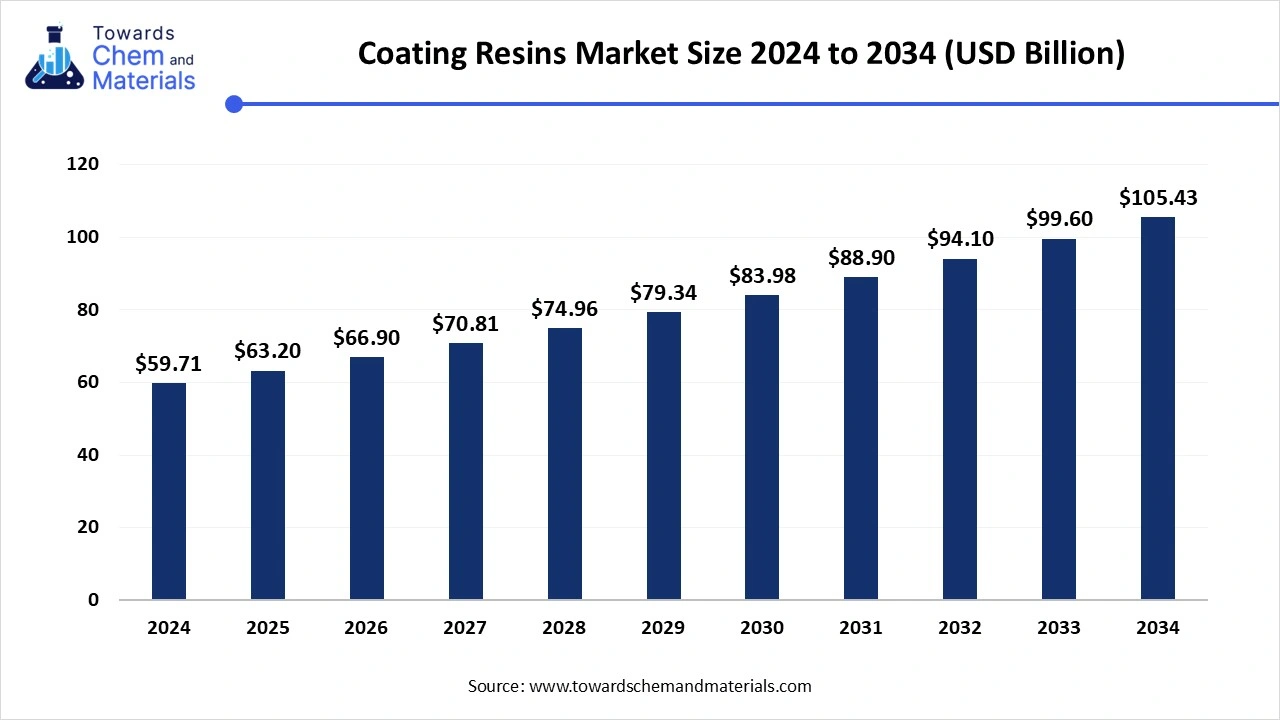

The global coating resins market size was valued at USD 59.71 bn in 2024 and is estimated to hit around USD 105.43 bn by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.The sudden surge toward sustainability and expansion of the automotive and transportation industry is propelling the market growth forward in the current industry environment.

The coating resins market has witnessed steady growth in the recent period. The rising need for durable, high-performance, and long-lasting coatings in several industries is primarily leading to market growth in the current scenario. Moreover, these resins are basically used in the production of coating, which has wide application in industries such as automotive, wood, and packaging these days.

The ongoing sustainability and environmental compliances are playing an important role in the growth of coating resins industries in recent years. Coating resins are gaining popularity attributed to their stronger adhesion properties for a wide range of surfaces. Moreover, technological advancements are anticipated to create significant market opportunities by developing innovative adhesion processes in the coming years.

The demand for specialized coating due to heavy adoption of electric vehicles has increased in the past period. Manufacturers are heavily using the different types of coating to build a stronger market position, ensuring the reliability of their vehicles nowadays. Moreover, the growing need for durable, lightweight, heat-resistant coatings is likely to contribute significantly to the growth of the coating resins.

| Report Attributes | Details |

| Market Size in 2024 | USD 59.71 Billion |

| Expected size in 2034 | USD 105.43 Billion |

| Growth Rate | CAGR of 5.85% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type, By Formulating Technology, By End Use, By Region |

| Key Companies Profiled | Hexion Inc,Arkema Group, Bayer AG ,The Sherwin-Williams Company ,Allnex Group, The Dow Chemical Company ,BASF SE ,Polynt SPA, Royal DSM ,Evonik Industries AG |

The growing demand for customized coating resins for specific industries is expected to create lucrative opportunities for the coating resin manufacturers during the forecast period. Some industries are looking for specific resin formulations that ensure specific performance needs in the current period. the trend for specification is recently seen in industries such as marine vessels, wind energy, defense, and aerospace.

Moreover, the manufacturers can create partnerships with these industries that are expected to first move forward in the coming years. Also, the establishment of a skilled workforce and R&D capabilities will provide significant market attraction during the forecast period for coating resin producers.

The unstable price of raw materials is projected to hamper the industry growth during the forecast period. Raw materials, such as petrochemical derivatives and others, are often dependent on the crude oil price and agricultural trends, which have a high instability of the price range.

Also, government initiatives towards sustainability are anticipated to become a nightmare for the VOC-based coating in the coming years, which can lower industry potential during the projected period. however, manufacturers can gain market traction by using technology advancement for the resin formulation in the coming years.

Asia Pacific led the coating resins market in 2024.

The region experienced remarkable growth in its manufacturing capabilities, mainly in the coating resins sector. This region is diverse and comprises multiple industries, each one exhibiting a high level of economic development. Ranging from the emerging market to more established economics. The main factor for the rising growth of region’s is the growth rate of the economy, with the substantial investment. The main sectors of the market are automotive, appliances, consumer goods, construction, and furniture.

The initiative from the government is mainly aimed at the development of infrastructure, and the renewal of urban areas has stimulated demand for coating resins. Increasing the utilization in multiple applications across the region.

From Skyscrapers to Sedans: China’s Coating Resin Demand Soars with Development

China is at the forefront of this growth. The country’s growth is attributed to a construction boom and building in the urban areas. the country is witnessing high demand for infrastructure development projects that require high-quality raw materials like coating resins. The increasing activities based on production and expanding construction create future opportunities for market expansion and Innovation in China.

Moreover, the expansion of the automotive industry is expected to contribute significantly to the development of the coating resins market.

| By Region | Revenue Share 2024 (%) |

| Asia Pacific | 46.19% |

| Europe | 23.09% |

| North America | 21.11% |

| Latin America | 5.85% |

| Middle East and Africa | 3.76% |

From Automotive to Architecture: Europe’s Coating Resins Market Shines With Smart Solutions

Europe is expected to grow at a significant pace in the market during the coming period. The development in sectors like oil & gas and the high amount of investment in infrastructure are helping to aid growth. The increasing adoption of powder coating due to its exceptional applications like superior durability, cost-effectiveness, and minimal environmental impact, is expected to fuel the market expansion.

Innovation in technologies has grown the efficiency of applications and finish quality, making powder coating the first and most preferred choice in automotive, industrial, and architectural areas. Rising sustainability awareness spreads, and the increasing demand for bio-based and low-emission coating solutions is further expected to accelerate the European market.

Bio-Based Breakthroughs and Industrial Advancements Strengthen Coating Resin Market in North America

North America expects notable growth in the coating resins market during the forecast period. The demand for coating resins in the region is increasing due to advancements in sectors like construction, aerospace, and automation. Rising emphasis on low VOC and sustainable coating is expanding market growth. The growing innovation in the formulation of resins helps to expand the market.

Activities like aging infrastructure renovation and rising construction for residential in countries like the U.S and Canada contribute significantly to this increasing demand. The electric vehicle and renewable energy solutions boost the need for high-performance coating. The possibility in the ongoing development of bio-based resins and smart coating help North America as a leader in advanced coating

The acrylic segment led of the coating resins market in 2024. Having the performance advantages, broader application, and versatility, the acrylic segment maintained its dominance over the years. By providing durability, balanced combination, and cost effectiveness, the segment gained a major market share in the current period. Also, architectural and building developers are actively seen in using acrylic-based resins for avoiding exceptional resistance to weathering and UV radiation for indoor and outdoor applications recently.

The alkyd segment is expected to experience significant market growth during the forecast period. The cost-effectiveness of the alkyd resins is anticipated to lead to market sales in the coming years.

The alkyd segment offers the easier production of coating to the manufacturers without any need for high-performance compromise. Moreover, the availability and affordability of raw materials for alkyd resin production will further contribute to the growth of the segment in the upcoming years.

The waterborne segment led the coating resins market in 2024. Having a combination of regulatory, performance, and environmentally friendly properties, waterborne technology has gained major market attraction in recent period. Also, the favorable government initiatives toward sustainability are leading the segment's growth in recent years.

| By Formulating Technology | Revenue Share 2024 (%) |

| Water-based coatings | 51.09% |

| Solvent-based coatings | 20.11% |

| UV-curved coatings | 14.18% |

| High solids coatings | 8.28% |

| Powder coatings | 6.34% |

Several industries are seen under pressure from government guidelines and increasingly seeking alternatives for the traditional solvent-based resins. Thus, the waterborne resins have risen as the ideal solution for these types of industries in the current period.

Solvent-based segment is expected to grow at a significant rate during the forecast period. With properties such as strong performance characteristics and suitability for harsh environments, the solvent-based segment is anticipated to gain market share in the coming years. Also, heavy-duty industries are actively demanding the solved-based coating akin to its abrasion resistance and excellent adhesion nowadays. The solvent-based coating has a faster drying and curing time, which will make it an ideal option for high-humidity environment workflows.

The architectural coatings segment held the dominating share of the coating resins market in 2024. The growing need for residential and commercial constructions has been leading the industry potential in recent years. The developers are seen in the increased usage of sealers, paints, primer, and varnishes for surface protection in the current period. the demand for aesthetic appeal of home decor will gain major industry share during the projected period.

The general industrial coating segment is anticipated to grow at the fastest rate during the projected period. The expansion of the manufacturing sectors will play a major role in the growth of the segment in the upcoming days. The coating resins help to protect, enhance, and improve the performance of a wide range of products' surfaces and components. Considering the versatility and adaptability of resin coatings, the demand from industries such as agriculture, heavy equipment, and mining is expected to increase in the coming years.

By Type

By Formulating Technology

By End-Use Industry

By Regional

April 2025

April 2025

April 2025

April 2025