April 2025

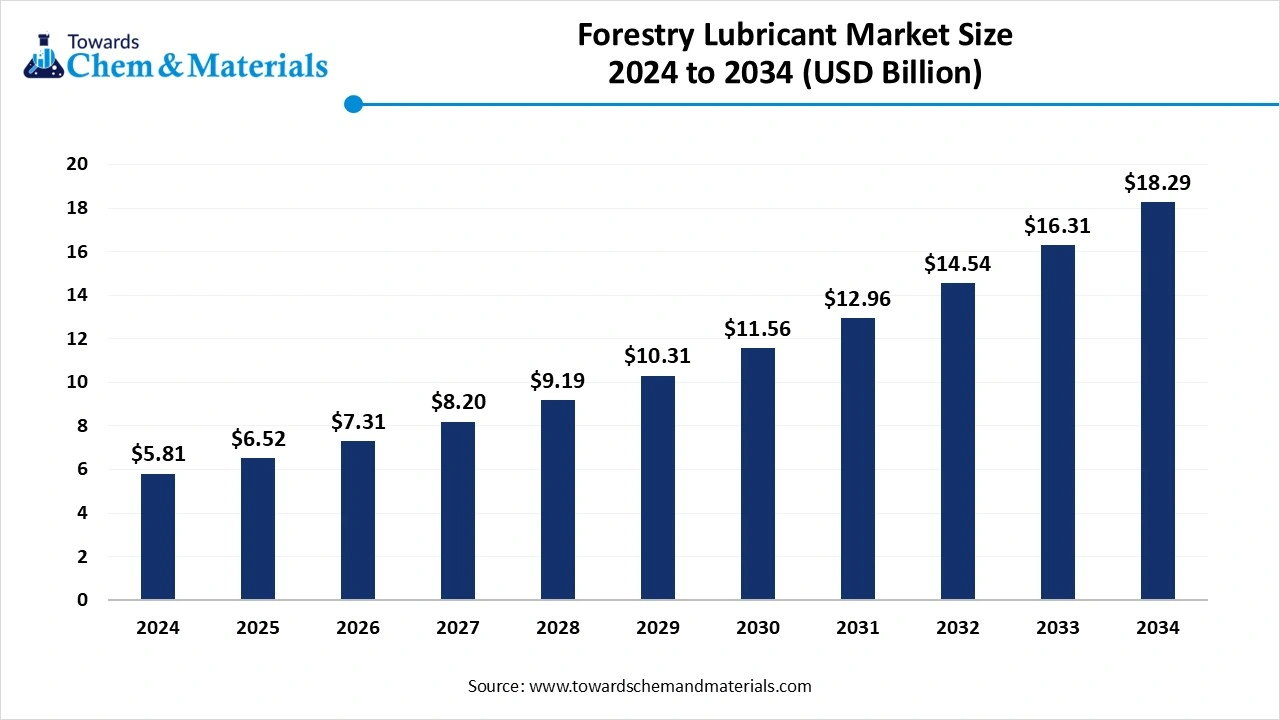

The global forestry lubricants market size is calculated at USD 5.81 billion in 2024, grew to USD 6.52 billion in 2025, and is projected to reach around USD 18.29 billion by 2034. The market is expanding at a CAGR of 14.59% between 2025 and 2034.The growing requirement of wood and timber products worldwide increases the demand for forestry operations, and the growing usage of high-performance machinery drives the market growth.

Forestry lubricants are specific lubricants established for utilization in the forestry sector. They are widely used in various forestry machines and equipment like harvesters, skidders, logger trucks, chainsaws, forestry tractors, shredders, and skidders. Forestry lubricants help to lower friction, sustain harsh environmental conditions, and minimize wear and corrosion of equipment and machines.

The growing utilization of pulp and paper increases the demand for timber, which drives the market growth. The growing usage of forestry equipment for activities such as processing timber, logging, and harvesting fuel the market growth. Factors like advancement and innovation in forest management techniques, growing requirement for high-performance lubricants, and adoption of sustainable and bio-based lubricants contribute to the overall growth of the forestry lubricants market.

The forestry industry is continuously researching new equipment to perform various forestry activities. The growing need for forestry equipment in the arket is due to various factors like economic growth, rising timber consumption, and the need for sustainable forestry practices.

The growing consumption of wood products and timber increases the demand for machinery to transport, harvest, and process the resources, which increases the need for equipment like processors, forwarders, harvesters, and many more. The growing adoption of sustainable practices requires machines that reduce environmental impact. The growing economy in various regions increases the demand for wood products and timber, which fuels demand for improved forestry equipment.

The growing urbanization and rapid growth in the construction sector fuel the demand for wood and timber, which directly increases the requirement for forestry equipment. Furthermore, the expansion of equipment manufacturers in various regions is the key driver for the forestry lubricants market growth.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.52 Billion |

| Expected Size in 2034 | USD 18.29 Billion |

| Growth Rate | CAGR of 14.59% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Equipments, By Application, By Base Oil, By Additives, By Region |

| Key Companies Profiled | Valvoline,Shell,BP,Castrol,LANXESS,Chevron Corporation,Quaker Chemical,Dow Chemical,ExxonMobil,TotalEnergies, Lubrizol,Ashlands,FUCHS Petrolub SE,Kluber Lubrication,Penine Lubricants,Petro Canada Lubricants,Rymax Lubricants |

The growing environmental concerns and stringent environmental regulations increase the demand for bio-lubricants. Bio-lubricants are a sustainable and environment-friendly alternative to traditional lubricants. The growing adoption of environmentally sustainable and eco-friendly forestry operations increases the demand for bio-lubricants.

Bio-lubricants are originated from natural and renewable sources like animal fats and vegetable oils. The oil is extracted from plants' seeds, fruits, waste cooking oil, microalgae, and many more resources. The stringent environmental regulations in various regions increase the demand for environment-friendly lubricants or lubricants that are less harmful, which fuels the demand for bio-lubricants. The ongoing technological development in the formulation of bio-lubricants to improve performance and cost creates a strong opportunity for the forestry lubricants market.

Despite several benefits of forestry lubricants, fluctuating raw material prices may restrict market growth. Fluctuations in raw material prices, such as petroleum-based products and crude oils, affect the prices of lubricant production. This increases prices for end products and decreases the purchase rate.

Fluctuations in cost create difficulty in processing supply chains, which leads to supply chain disruptions. Volatility in raw material prices creates restrictions for investment in advanced technologies and eco-friendly lubricants. Fluctuations in raw material prices increase overall production costs and reduce profit margins. Furthermore, factors like changing government policies, natural disasters, and trade disruptions are responsible for cost fluctuations and that overall hampers the market growth.

Asia Pacific dominated the forestry lubricants market in 2024. The growing demand for paperboard, paper, and wood products drives the growth of the market. The expansion of forestry industries increases the demand for equipment and machinery for transportation, harvesting, and processing of timber, which increases the demand for forestry lubricants.

The presence of mineral oil in the region drives the market growth. The rising demand for biodegradable lubricants helps in market growth. The presence of the manufacturing sector and rising disposable income increases the demand for forestry lubricants. Furthermore, the government's substantial investment in infrastructure development and growing demand from the automotive and industrial sectors drive the market growth.

China is observed to be the major contributor to the forestry lubricants market. The rising domestic demand for wood products in the country drives the market growth. The growing expansion of the forestry industry increases the demand for forestry lubricants for various forestry machines, such as processing equipment, harvesters, and log loaders. Modernization of the forestry industry increases demand for mechanization of equipment that fuels demand for specialized forestry lubricants. The growing environmental issues increase the demand for biodegradable forestry lubricants. Furthermore, growing reforestation activities and large production of forestry lubricants contribute to market growth.

North America is experiencing the fastest growth in the market during the forecast period. The presence of a strong and technologically advanced forestry sector increases the demand for certain specialized equipment, which drives the market growth. The well-established manufacturing sector in industries such as heavy equipment and automotive increases the demand for forestry lubricants. Stringent environmental rules and regulations fuel the demand for sustainable forestry lubricants.

The strong presence of the lubricant manufacturing industry and prominent export capacity drive the market growth. Additionally, the rising consumer demand from the automotive and transportation industry propels market growth in the region.

United States drives the forestry lubricants market

United States holds the highest market share of the forestry lubricants market. The growing demand for specialized forestry lubricants to sustain harsh conditions drives the growth of the market. The well-established manufacturing base in the production of a variety of lubricants fuels market growth. The well-established research & development sector and strong presence of forestry lubricants suppliers & distributors support the growth of the market. Furthermore, strict environmental rules and regulations increase the demand for bio-based forestry lubricants, which contributes to overall market growth.The United States exported $2.19 billion in lubricating products in 2023.

The hydraulic oils segment held the dominating share of the forestry lubricants market. The growing demand for forestry machines, such as skidders and harvesters, drives the market growth.

Hydraulic oils are required for lubrication, sealing, power transmission, and cooling in forestry machines. The growing need for protection against wear & tear, corrosion, and abrasion increases the demand for forestry lubricants. The versatility of hydraulic oils, such as sustain in extreme pressures and temperature variations, drives the market growth. The growing demand for cost-effective and enhanced performance oils promotes overall market growth.

The chain oils segment is observed to grow at the fastest rate in the market during the forecast period. The growing demand for chainsaws for cutting trees drives the market growth. The growing mechanization in machines increases the demand for efficient and reliable lubricants, which increases the demand for chain oils. These oils sustain in extreme conditions like wear & tear and friction. The strong research and development in formulations of oils fuel the market growth. Furthermore, the growing wood production and adoption of sustainable forestry practices drive the growth of the market.

The chainsaws segment dominated the forestry lubricants market with the largest share in 2024. The growing demand from various forestry tasks like clearing land, processing timber, and felling trees drives the market growth. Chainsaws maintain the proper functioning and longevity of forestry machines.

They help to sustain harsh environmental conditions and high stress levels. The growth in logging activities and the need for precision cutting increases the demand for forestry lubricants. Furthermore, rapid civilization and infrastructure project developments increase the requirement of wood-based products like building materials, firewood, and lumber, driving the overall market growth.

The harvester’s segment is experiencing the fastest growth in the market during the forecast period. Versatility in harvesting processes and growing mechanization drive the market growth. The development of advanced technologies, such as control systems and artificial intelligence, helps in market growth. The growing demand for less maintenance cost and higher lifespan equipment increases the demand for harvesters.

The cutting segment held the largest share of the forestry lubricants market in 2024. The rising utilization of chainsaws and other cutting tools in forestry operations and logging operations drives the market growth. They are designed for unique operations like corrosion protection, oil film strength, and high-temperature performance. The growing demand for friction minimization, preventing wear & tear, and enhanced smooth cutting performance drives the growth of the market.

The transporting segment is the fastest growing in the market during the forecast period. The growing demand for transportation of forestry equipment using trailers, trucks, and other machinery drives the market growth. The rising logs, felled trees, and other wood products from forests and end-users increase the demand for transportation facilities. In transportation, lubricants assure vehicle operation and lower fuel consumption and downtime. The efficient lubrication of vehicles reduces emissions and fuel consumption. Furthermore, the rising demand for smooth and efficient transportation of wood products and other forestry products drives the market growth.

The mineral oils segment dominated the forestry lubricants market in 2024. The cost-effectiveness and ready availability drive the growth of the market. These oils are manufactured in various sectors like oil, metal, mining, and many others. The growing applications in various industries and its effectiveness in forestry lubricants increase the demand for mineral oils. These oils offer thermal and oxidative stability due to their hydrocarbon structure. The versatility of applications in forestry, like grease applications, hydraulic systems, and gearboxes, drives the market growth.

The synthetic oils segment is experiencing the fastest growth in the market during the forecast period. The growing demand for high-performance and longer shelf-life lubricants drives the market growth. These oils are less prone to oxidation and ensure the efficient running of forestry machines. They consist of a higher viscosity index and excellent flowability at lower temperatures. Furthermore, strong investment in research and development of synthetic oils formulations drives the growth of the market.

The anti-wear segment dominated the forestry lubricants market with the largest share in 2024. The growing demand for protection against wear & tear and damage caused due to friction drives the market growth. Forestry machines perform under harsh conditions such as exposure to dust & debris, extreme temperatures, and high loads, which increases wear and tear of machine components that increases demand for anti-wear additives. They lower friction, prevent wear, and form protective layers on metal. The growing utilization of forestry machines with extended lifespans and less downtime drives the market growth.

The anti-corrosion segment is the fastest growing in the market during the forecast period. The development of harsh conditions like exposure to chemicals & moisture and high temperature increases corrosion in machines, driving the market growth. They protect from the high repair cost of materials. Rust and corrosion destroy structural components, and anti-corrosion additives offer safety for machinery hazards. Furthermore, technological innovation in anti-corrosion coating formulation and corrosion inhibitors drives the market growth.

By Type

By Equipment

By Application

By Base Oil

By Additives

By Regional

April 2025

April 2025

April 2025

April 2025