April 2025

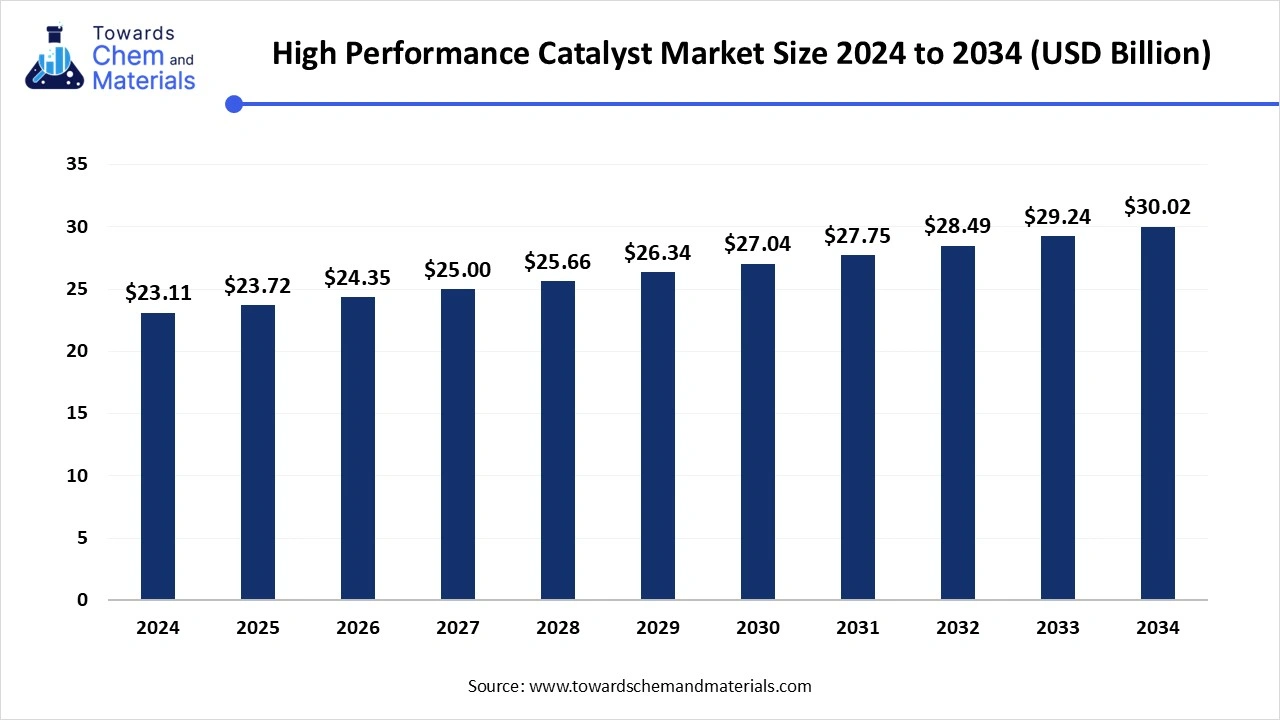

The global high-performance catalyst market size is calculated at USD 23.11 billion in 2024, grew to USD 23.72 billion in 2025, and is projected to reach around USD 30.02 billion by 2034. The market is expanding at a CAGR of 2.65% between 2025 and 2034. The market encompasses advanced catalytic materials designed to accelerate chemical reactions while enhancing efficiency, selectivity, and sustainability across industrial processes.

The high-performance catalyst market is experiencing robust growth, propelled by increasing demand across key sectors such as petrochemicals, automotive, pharmaceuticals, and environmental applications. These catalysts are engineered to operate under extreme conditions, offering superior activity, stability, and selectivity, which significantly enhances reaction efficiency and reduces energy consumption.

Growing environmental regulations and the push for sustainable and green chemistry have further accelerated the adoption of advanced catalytic technologies.

Additionally, innovations in nanotechnology and material science are enabling the development of next-generation catalysts with enhanced performance metrics, supporting cleaner fuel production, emissions reduction, and energy-efficient industrial processes.

As industries continue to seek cost-effective and eco-friendly alternatives, the high-performance catalyst market is poised to expand steadily over the coming years.

With the pressing need to transition toward greener and more efficient industrial operations, the market is not only expanding in size but also evolving in sophistication.

Emerging economies in Asia-Pacific and Latin America are expected to present lucrative opportunities, fueled by rapid industrialization and supportive government policies. As a result, the market is set to witness continuous innovation and strategic collaborations aimed at addressing future energy and environmental challenges.

| Report Attributes | Details |

| Market Size in 2025 | USD 23.72 Billion |

| Expected Size in 2034 | USD 30.02 Billion |

| Growth Rate | CAGR of 2.65% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Market Type, By Application, By End-User, By Active Component, By Region |

| Key Companies Profiled |

Arkema, Johnson Matthey, BASF, Zeolyst International, SABIC, Albemarle, Honeywell, LyondellBasell, Haldor Topsoe Ashland, Clariant, Shell, Chevron Phillips Chemical, ExxonMobil, Evonik Industries |

The high-performance catalyst market is witnessing transformative momentum driven by evolving industrial needs and global sustainability goals. A primary market driver is the increasing environmental compliance pressure on industries to adhere to stringent environmental regulations.

Governments and regulatory bodies across the globe are enforcing emission standards that necessitate cleaner and more efficient industrial processes. This compels industries to adopt high-performance catalysts, which are critical in reducing emissions and enhancing process efficiencies across sectors such as refining, chemicals, and power generation.

A significant market opportunity lies in the rapidly expanding hydrogen economy. As nations push towards decarbonization, hydrogen emerges as a clean and promising energy vector. High-performance catalysts play a vital role in hydrogen production, storage, and in fuel cells making them essential for scaling up hydrogen infrastructure globally.

The market continues to face challenges, notably the high production costs associated with these catalysts. The reliance on rare and precious metals, such as platinum and palladium, significantly elevates production expenses.

Furthermore, the complex research and development processes needed to create efficient, stable catalysts limit their widespread commercial deployment. This cost factor remains a key hurdle, especially for small- and medium-scale enterprises which limit the expansion in the high-performance catalyst market.

North America dominates the high-performance catalyst market in 2024. The growth of the market is attributed due to its strong industrial base, advanced technological infrastructure, and stringent environmental regulations. The region has seen substantial investments in refining, petrochemical, and environmental sectors, where the adoption of high-performance catalysts is crucial for enhancing process efficiency and reducing emissions.

Additionally, the presence of leading market players such as Albemarle Corporation, W. R. Grace & Co., and Honeywell UOP further reinforces North America's dominance through continuous innovation and large-scale production capabilities.

Europe expects the fastest growth in the market during the forecast period. The growth of the market is attributed due to homogeneous precious metal catalyst segment. This growth is primarily fueled by the region's well-established chemical manufacturing base and increasing pressure to comply with strict environmental regulations. Projections suggest a strong compound annual growth rate in the forecasting period, signaling Europe's rising dominance in this space.

Countries such as Germany and U.K are witnessing a surge in demand for cleaner and more sustainable catalytic processes across various industries including energy, automotive, and pharmaceuticals. The region also benefits from favorable government initiatives, increased R&D activities, and growing foreign direct investments.

Key players operating in this region include BASF SE, Johnson Matthey, and Umicore, all of which are actively expanding their footprint through strategic partnerships and innovation.

Heterogeneous catalysts segment dominated the high-performance catalyst market in 2024. The growth of the segment is attributed due to their reusability, ease of separation, and widespread industrial application, especially in large-scale chemical and petrochemical processes. Their solid-state nature makes them ideal for continuous production environments, contributing significantly to operational efficiency.

Homogeneous catalysts segment expects significant growth in the market during the forecast period. The growth of the segment is attributed due to their higher selectivity and efficiency in fine chemical and pharmaceutical synthesis. Their rapid adoption in specialized applications is driving innovation and expansion in niche sectors.

The petrochemical segment dominates high-performance catalyst market in 2024. The growth of the segment is owing to the heavy reliance on catalysts for cracking, reforming, and hydro processing operations. The global demand for refined fuels and petrochemical derivatives continues to sustain this dominance.

Chemical synthesis segment expects substantial growth in the market during the forecast period. The need for precision, sustainability, and innovation in specialty and fine chemicals drives the adoption of high-performance catalysts with advanced capabilities.

The automotive industry segment dominates high-performance catalyst market in 2024. The growth of the segment is supported by the increasing need for catalytic converters that help meet stringent vehicle emission regulations. Catalysts are crucial for transforming harmful exhaust gases into less toxic substances, making them indispensable in this sector.

Chemical manufacturing segment is experiencing significant growth in the market during the forecast period. The growth of the segment is attributed due to growing demand for specialty chemicals, sustainable production methods, and advancements in catalyst technologies that enable greener and more efficient processes.

Noble metals segment dominates high-performance catalyst market in 2024. The growth of the segment is attributed due to their exceptional catalytic properties, especially in emission control and refining processes. Their high efficiency and reliability make them a preferred choice for high-performance catalytic applications.

Transition metals segment expects significant growth in the market during the forecast period.

The transition metals like nickel, copper, and cobalt are the fastest-growing category, owing to their cost-effectiveness, availability, and increasing use in emerging applications, including green chemistry and renewable energy systems. These metals are gaining traction as viable alternatives to reduce dependency on expensive noble metals.

Evonik

Advait

April 2025

April 2025

April 2025

April 2025