April 2025

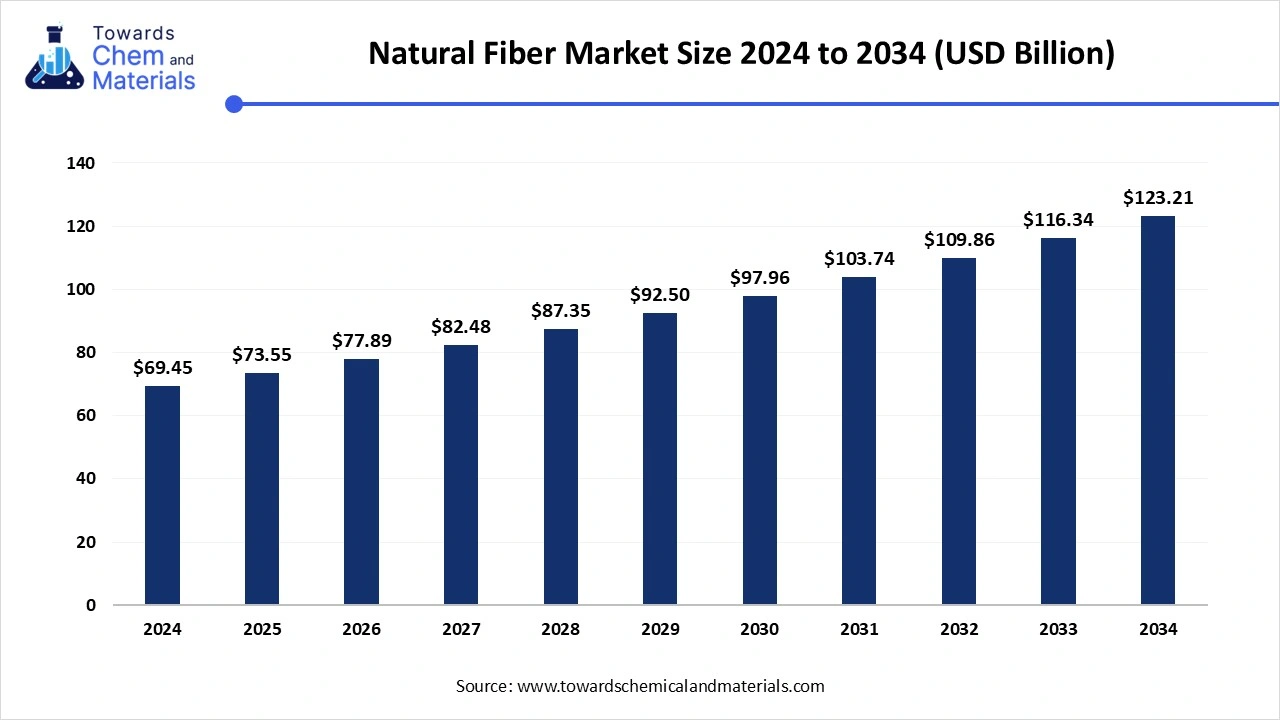

The natural fiber market size surpassed USD 73.55 billion in 2025 and is estimated to hit around USD 123.21 billion by 2034 growing at a CAGR of 5.9% from 2025 to 2034. the need for biodegradable materials and the increased adoption in industries for multiple uses is expected to support long-term industry progression.

The natural fiber market witnessed continuous growth in the recent period. Rising demand for biodegradable materials and eco-friendly fiber types has played a major role in market growth in past years. Countries all over the world are implementing several rules and regulations towards making a sustainable environment which have created significant opportunities for natural fiber makers nowadays. Also, larger manufacturing companies are actively trying to reduce carbon emissions and make sustainable product lines these days. Thus, lucrative opportunities to invest in natural fiber are seen rising nowadays.

The technological advancements in natural fiber are expected to drive greater market expansion in the coming period. The challenges associated with traditional natural fiber such as performance and durability limitations, modern technologies can help to improve it by more precisely using some research and advanced process. The manufacturing companies are actively investing in advanced technologies such as enzymatic treatments, fiber reinforcement techniques, and nanotechnology

| Report Coverage | Details |

| Market Size in 2025 | 73.55 Billion |

| Expected Market Size in 2034 | 123.21 Billion |

| Projected CAGR 2025 to 2034 | 5.90% |

| Dominant Region | Asia Pacific |

| Base Year | 2024 |

| Segmants Covered | Plant-based fiber, animal-based fiber, region |

| Key Companies Profiled | Vardhaman Textiles Limited, Grasim Industries Limited, ANANDHI TEXSTYLES, Bcomp, The Natural Fibre Company, Procotex, FlexForm Technologies, Bast Fibre Technologies Inc., Lenzing AG, Barnhardt Natural Fibers. |

The expansion of the biobased packaging industry is anticipated to create lucrative growth opportunities for the natural fiber market. Having a large consumer base in the packaging industry can develop substantial sales of natural fiber in the coming years. Also, manufacturers can build partnership initiatives with packaging

Limited availability and price fluctuation are expected to hamper the industry growth during the forecast period. as natural fibers are made up of crops that can have seasonal variations sometimes. Moreover, extreme weather conditions can hinder supply levels, and sometimes that can create price fluctuations and supply chain issues in the coming years. However, these issues are expected to be solved by technological development such as advanced farming practices, the development of standard grading systems for fibers, and others in the future.

Asia Pacific dominated the natural fiber market in 2024. Many natural fiber-producing countries such as India, China, Bangladesh, and Indonesia will gain substantial market share in the coming years. These countries have a long history of natural fiber production and historical farming techniques, ensuring easy raw material sourcing and a well-established supply chain in the regional countries. The availability of the leading textile firms and the further investment by the government on the use and development of natural fiber is accelerating the growth of the natural fiber market in the region.

China is expected to rise as a key country for natural fiber in the coming years. The advanced textile industry can lead the China's growth in the natural fiber market in the future due to the country seen in aggressively pushing sustainable fashion in the current period. Moreover, China’s heavy investments in fiber technologies are likely to contribute heavily to market growth in the projected period.

North America expects the fastest growth in the market during the forecast period. Having strong industrial infrastructure, upcoming demand for sustainable packaging, and adoption of modern technology are leading the market growth in the region. The automotive industry is seen in the substantial use of natural fiber in the region. The industry has been heavily using this natural fiber incorporating fiber-reinforced plastic in recent years. Furthermore, natural fiber-based textiles are consuming a major market share in the region.

The United States maintained its leading position in the North America. Advanced research and development capabilities, modern agriculture practices, and a heavy industrial need for sustainable products are driving the market expansion of natural fiber in the country. The latest trend such as sustainable fashion is creating growth opportunities for natural fiber in the United States nowadays. Fashion brands are seen heavily producing organic fabric made of organic cotton and hemp-based fabrics. Bio-based textile coating and Waterless dyeing are the procedures gaining

The cotton segment held dominant position in the natural fiber market in 2024. The higher consumer demand, easy availability, and wide use made the segment accelerate the demand for the segment. The growth of the cotton segment is also led by factors such as comfort and usability. With a softer and more attractive texture, cotton has risen as the preferred choice for the consumer over the days. The extensive global production network is further boosting the segment in the current period. Countries such as China, the United States, and India have been heavily invested in cotton production in recent years.

The hemp segment is expected to gain substantial market share in the coming period. The versatility, durability, and exceptional strength will drive the growth of the segment. Moreover, the automotive and construction segment is expected to contribute heavily to segment expansion in the coming days as hemp fiber is used in the interior panels of cars due to its lightweight properties. Also, the construction industry is making a change by using innovative concrete materials such as hempcrete for carbon footprint reduction.

The wool segment dominated the natural fiber market in 2024. The demand from multiple industries has been driving segment growth in recent years. Having superior insulation properties, making it a preferred choice for thermal insulations nowadays. Moreover, high sustainability and durability are continuously making this segment a key choice for the fabrication industry. Wool having hypo-allergic and moisture-wicking properties can segment dominance in the coming years also.

The silk segment expects significant growth in the market during the forecast period. The modern advancements in silk production and increased demand for luxury textiles are projected to fuel segment expansion in the next decade. The premium home décor industry and ultra-luxurious fashion brands are heavily dependent upon silk nowadays as demand for luxury items which are made of silk increased. Also, silk is now being used in the medical industry as silk fiber in wound dressing and tissue engineering.

By Plant-based Fiber

By Animal-based Fiber

By Regional

April 2025

April 2025

April 2025

April 2025