April 2025

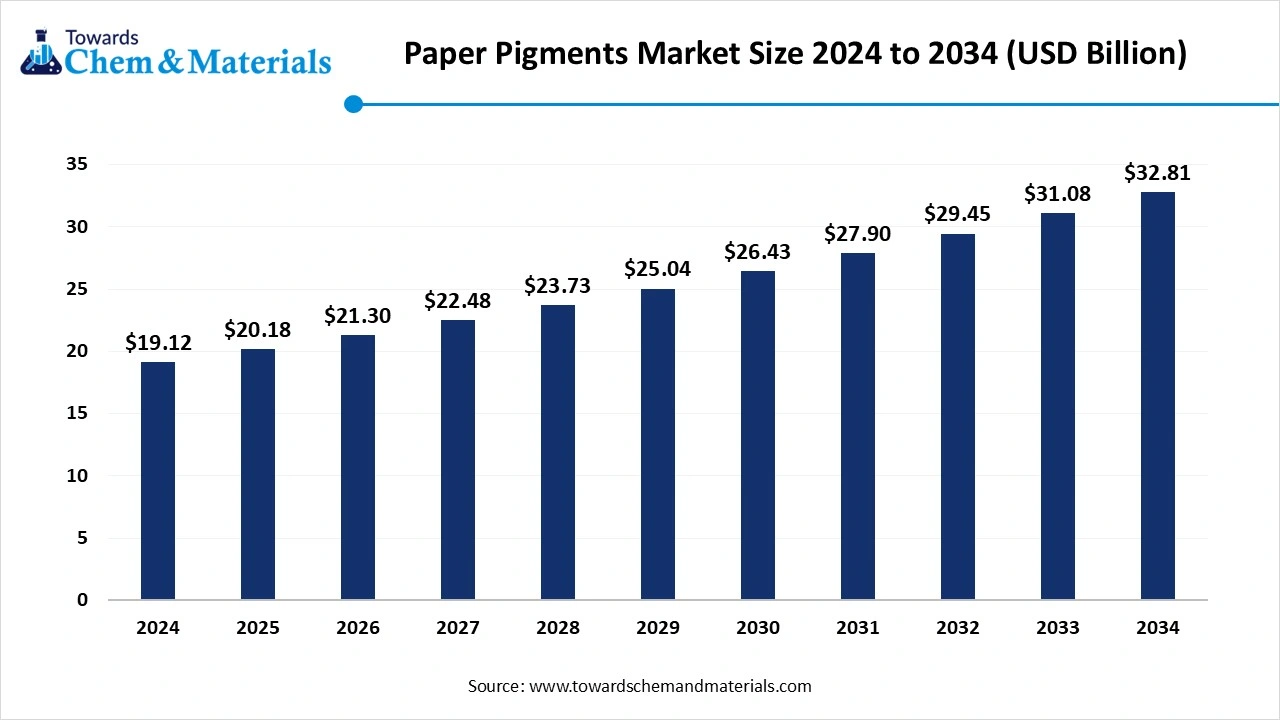

The global paper pigments market size was valued at USD 19.12 billion in 2024 and is estimated to reach around USD 32.81 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.55% during the forecast period 2025 to 2034. The rapid expansion of the packaging industry and growing utilization of high-quality paper goods drive the market growth.

Paper pigments are organic, inorganic, fine, and soluble solid powder which are used to coat or color papers. Pigments are available in various hues and shades. They create a coating layer on paper and are also used as fillers in uncoated paper.

Pigments enhance the opacity and provide brightness, gloss, smoothness, and printability to paper. They help to enhance printing quality and offer longevity to printed material. There are two types of paper pigments available: inorganic and organic pigments. Inorganic pigments originate from mineral-based compounds and offer durability and resistance to heat, chemicals, and light. Titanium dioxide, cadmium pigments, chromium pigments, and iron oxides are widely used inorganic pigments.

Organic pigments originate naturally from carbon-based compounds and offer transparency and intense and vibrant colors. The organic pigments include lake of allura red, lake of indigo carmine, and lake patent blue. Paper pigments are widely used in various applications, including printing paper, tissue paper, decorative papers, writing paper, corrugated boxes, visiting cards, invitation cards, labels, tags, and posters. The rapid urbanization in various regions increases the demand for packaging and printing, which drives the market growth.

The rapid expansion of the packaging industry in the industrial, commercial, and publishing sectors supports the market growth. Factors like advancement in pigment technology, requirement of higher quality paper, and rapid growth in the printing ink industry contribute to market growth.

The rapid expansion of e-commerce increases the demand for packaging materials. The growing trend of online shopping increases the requirement for packaging, which increases the growth of paper pigments. The rising demand for cartons, corrugated boxes, and other packaging materials depends on paper pigments. The rising trend of creating brand image through packaging to enhance consumer experience that uses paper pigments.

Consumers are aware of the harmful effects of plastics on the environment, which increases the demand for sustainable packaging, and this encourages e-commerce companies to embrace sustainable packaging practices. The rising demand for print labels, promotional materials, and brochures increases the demand for paper pigments. The rapid expansion of e-commerce globally is a key driver for the paper pigments market.

| Report Attributes | Details |

| Market Size in 2025 | USD 20.18 Billion |

| Expected Size in 2034 | USD 32.81 Billion |

| Growth Rate | CAGR of 5.55% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type, By Application, By Region |

| Key Companies Profiled | Kemira Oyj,The Chemours Company,IMERYS,BASF SE,Omya AG,Minerals Technologies,Ashapura Group,Thiele Kaolin Company,Huber Corporation,KaMin LLC. / CADAM, Aditya Birla Chemicals,Cabot Corporation,En-Tech Polymer Co., Ltd.,DuPont,Hansol Chemicals,GAB Neumann GmbH,Minerals Technologies Inc.,J.M. Huber Corporation |

The growing demand for sustainable packaging in online, retail, and e-commerce sections increases the demand for sustainable paper pigments. The growing consumer awareness regarding various environmental problems increases the demand for paper-based packaging like paper bags, paperboard, cartoon boxes, and corrugated boxes. There is a rising need for pigments made from renewable resources that can give appropriate brightness, printability, and color to packaging materials.

The eco-friendly pigments and low-VOC pigments cause less harm to the environment. The sustainable pigments are extracted from algae-based inks, vegetable-based inks, soy-based inks, and UV-curable inks. The growing adoption of sustainable packaging in brands helps them to enhance brand image and attract eco-conscious consumers.

The rising adoption of sustainable packaging from various sectors like food & beverage, consumer goods, and pharmaceuticals increases the demand for sustainable packaging options. The ongoing innovation in sustainable packaging solutions creates a strong opportunity for paper pigments market growth.

Despite several benefits of paper pigments, the volatility in raw material prices hampers market growth. The production of paper pigments totally depends on raw materials like kaolin, calcium carbonate, and titanium dioxides, which restrict the market growth. The fluctuations in the price of raw materials impact the profitability of the market. Factors like weather conditions, mining disruptions, geopolitical factors, and demand imbalances are responsible for the fluctuating costs of raw materials.

The volatility in raw material prices increases manufacturing costs. The fluctuating price of chemicals utilized in pigment generations can restrain market growth. Furthermore, supply chain disruption and changes in production costs restrict the paper pigments market growth.

Asia Pacific dominated the paper pigments market in 2024. The growing industrialization in the region increases the demand for paper and packaging material, which drives the growth of the market. The well-developed packaging and paper industries in the region increase the demand for paper pigments. The rising adoption of sustainable materials and lower production costs in the region fuels market growth.

The growing demand for high-quality coated paper like slick paper, enamel paper, and gloss paper increases the need for paper pigments. The well-established paper manufacturing industry and growing innovations in paper pigments technology propel market growth. The rising usage of cover papers, brochures, tissue paper, specialty papers, and envelopes drives the market growth.

China held the largest share of the paper pigments market in 2024. The well-established paper pigments manufacturing industry and multiple applications like textiles, printing inks, paints, plastics, and coatings drive the growth of the market. The growing population increases the demand for paper products like coated paper, printing paper, tissue paper, and writing paper, which increases the demand for paper pigments. The growing innovation and strong focus on the production of high-quality paper pigments contribute to market growth.

India is the fastest growing in the Asia Pacific region during the forecast period. The growing usage of hi-tech applications like optoelectronic displays and photo-reprographics drives the market growth. The growing literacy rates and strong emphasis on the educational system increase the demand for textbooks and notebooks, supporting market growth.

The rapid economic growth and strong investment in infrastructure projects increase the demand for paper pigments. The growing modernization in India increases the demand for paper products, which drives the market growth.

India's paper export industry is growing, and it reached $9.96 billion in 2024.

Europe is experiencing the fastest growth in the market during the forecast period. The strong presence of consumer goods and e-commerce in the region increases the demand for packaging, which drives the market growth. The growing demand for packaging in various industries like pharmaceuticals, food & beverages, and cosmetics drives the market growth.

The growing focus on environmental protection and sustainability increases the demand for sustainable paper pigment production. The strong investment in research and development to enhance pigment formulations drives the market growth.

Germany held the dominating share of the paper pigments market in 2024. The focus on producing high-performance pigments and technological advancement in pigment production drives the market growth. The rapid growth in 3D printing and digital printing technology increases the demand for paper pigments. The strong presence of the construction industry and the growing automotive sector increases the demand for coatings and paints, which drives the market growth.

United Kingdom is observed to be growing at the fastest rate in the paper pigments market. The rising demand for high-quality coated paper in applications like printing and packaging drives the market growth. The rising adoption of sustainable pigments and dyes increases the demand for paper pigments. The growing innovation in the development of high-performance pigments fuels the market growth. The growing demand for coated papers and stringent environmental regulations for the utilization of certain pigments contribute to market growth.

North America is growing at a notable rate in the paper pigments market. The growing consumer spending on paper-based products and economic expansion drive the market growth. The growing demand for different types of papers, like uncoated and coated, increases the demand for paper pigments. The rising adoption of sustainable packaging and growing innovation in pigment manufacturing technology drive the market growth. The presence of major industries, including publishing, packaging, and printing, and growing demand from various sectors contribute to market growth.

The calcium carbonate segment dominated and held the largest share of the paper pigments market in 2024. The wide application in the production of a variety of papers like tissue paper, high-quality printing paper, and drafting paper drives the market growth. This enhances paper properties like smoothness, opacity, printability & durability and can be used as coatings & fillers.

The rising demand for environment-friendly and sustainable material fuels the market growth. This material is natural and reduces the environmental footprint. Calcium carbonate encourages alkaline and neutral papermaking methods and enhances the longevity of paper. Furthermore, the versatility of calcium carbonate in creating both uncoated and coated paper drives the market growth. The cost-effectiveness and easy availability contribute to the growth of the market.

The kaolin segment is experiencing the fastest growth during the forecast period. The strong durability, strength, and overall longevity drive the market growth. It is also called China clay, and it enhances the paper's performance and appearance. The pigment holdout and better ink absorption quality drive the market growth. The rising demand for sustainable and environmentally friendly packaging increases the demand for kaolin. The wide applications of kaolin, like rubber, coatings, ceramics, and paints, drive the market growth. Furthermore, distinctive properties like chemical inertness, fine particle size, and platy particle shape promote market growth.

The dull-coated segment dominated the paper pigments market in 2024. The rising demand for matte finish, whiteness, and brightness paper drives the market growth. The growing demand for catalogues, brochures, and flyers from the corporate sector increases the demand for dull-coated paper pigments. The growing usage of magazines, publications, and graphics helps in market growth. The rising demand for packaging due to online platforms increases the demand for dull-coated paper, which offers a premium and sophisticated feel. Additionally, rapid growth in the food and beverage industry increases the demand for premium packaging that contributes to the growth of the market.

| By Application | Revenue Share 2024(%) |

| Coated Paper | 62.19% |

| Uncoated Paper | 37.81% |

The uncoated segment is observed to grow at the fastest rate during the forecast period. The growing demand from various applications like packaging, printing, and writing fuels the market growth. The rapid adoption of eco-friendly packaging solutions and growing digital printing increases the demand for uncoated paper. These papers are made up of renewable resources, and they are biodegradable and recyclable. The rising demand for textured and natural-looking papers increases the demand for uncoated paper. Furthermore, the cost-effectiveness and growing demand for plastic alternatives drive the market growth.

By Type

By Application

By Regional

April 2025

April 2025

April 2025

April 2025