April 2025

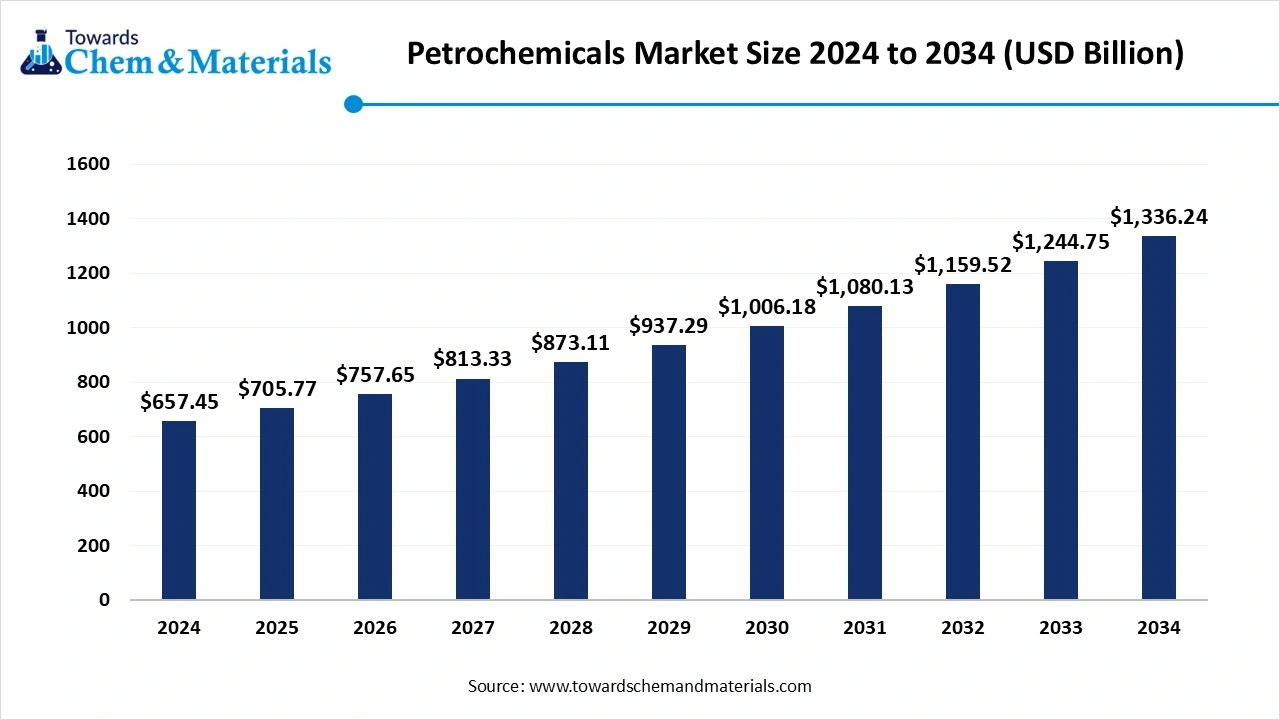

The global petrochemical market size was reached at USD 657.45 billion in 2024 and is estimated to surpass around USD 1,336.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.35% during the forecast period 2025 to 2034. The need for industrial application and increasing demand for petrochemical market.

The petrochemical market has witnessed fast-paced growth in the recent period. Having wide applications in several industries such as packaging construction, automotive, agriculture, and textile, petrochemicals have gained major market share in the current period. Petrochemicals are made from crude oil and natural gases, which help the development of products such as plastics, fertilizers, adhesives, and others. These unique development characteristics are providing a heavy consumer base to the petrochemical manufacturers from recent years.

However, this use of the traditional petrochemical can be limited for some years due to increasing initiatives and sustainable alternatives in recent years. Also, manufacturers are seen investing R&D activities for the biobased petrochemical for upcoming years as per the latest

The extending use of petrochemicals in the development of construction materials is driving the market growth of petrochemicals in the current industry scenario. Moreover, these materials, such as insulation foams, PVC pipes, and adhesives, are providing a heavy consumer base to the petrochemical manufacturers from recent years.

Furthermore, the automotive industry is ready to gain a substantial market share of the petrochemical market in upcoming years due to the increasing need for plastic and synthetic materials. Also, the manufacturers are seen in expanding plant capacities by adopting modern infrastructure developments with the proper use of technological advancments nowdays

| Report Attributes | Details |

| Market Size in 2025 | USD 705.77Billion |

| Expected size in 2034 | USD 1,336.24 Billion |

| Growth Rate | CAGR of 7.35% from 2025 to 2034 |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Region |

| Key Companies Profiled | BASF SE,Chevron Corporation,China National Petroleum Corporation (CNPC),China Petrochemical Corporation,ExxonMobil Corporation,INEOS Group Ltd.,LyondellBasell Industries Holdings B.V.,Royal Dutch Shell PLC,SABIC,Dow |

The expansion of the e-commerce and food delivery sectors is causing greater demand for petrochemical-based packaging solutions which further create the lucrative opportunity in the petrochemical market during the forecast period. Also, the need for lightweight and durable packaging options is severely contributing to the sales of the polyethylene material in the current period. Also, manufacturers can gain maximum industry advantages by promoting smart packaging solutions, such as single-use plastics and others.

Moreover, several brands are seen promoting their products in customized packaging, thus, the manufacturers can create a partnership with them, which could be a better investment for the future by observing market circumstances.

The unstable price range of crude oils is anticipated to hamper the petrochemical market growth during the projected period, as crude oil is considered an essential element in petrochemical production. Moreover, increasing geopolitical tensions and disruption in supplies of raw materials can have a huge impact on crude oil exports in the coming years.

Also, increasing sustainability standards and governmental stringent regulation for usage of traditional petrochemical production, which leads to CO2 emissions, are likely to hinder market potential during the forecast period as per observations. However, the manufacturer can reduce this impact by implementing the latest technological solutions and increasing the use of recyclable and eco-friendly materials in their productions from now on.

Asia Pacific dominated the petrochemical market in 2024. The presence of enlarged chemical industries and heavy domestic demands is a major contributing factor to the regional petrochemical market potential recently. Moreover, countries like China, India, Japan, and South Korea have been seen in developed manufacturing infrastructures, which are creating the heavy petrochemical demand in the current market scenario.

Moreover, the demand for plastics, tiles, and fertilizers has provided a huge consumer base to the petrochemical exporters in recent years. Also, having an enlarged population leading to the demand for products such as electronics, housing, and others is apparently going to help the petrochemical industry gain major market share in the future.

China is the leading country in the petrochemical market in the Asia Pacific region. This dominance of China is attributed to major factors such as heavy production industry and active investments in the market. Moreover, China is considered one of largest exporters and the consumer of petrochemicals in the current period. Also, favorable government policies and greater infrastructure are majorly contributing to the growth of the country from the past period. The government is seen in providing subsidies and other tax benefits to domestic business in China currently.

Europe is expected to grow at a significant pace in the petrochemical market during the coming period. Europe has an established industrial base with the heavy requirement of petrochemicals in the current period. Also, the producers of petrochemicals in Europe are seen shifting towards specific chemicals for the high-performance materials.

This sudden shift is anticipated to increase the demand for petrochemicals during the forecast period. Furthermore, major countries such as the United Kingdom, Germany, and France are observed in investing in petrochemical plant expansions according to their country’s future needs.

Middle East and Africa are expected to grow at a notable rate during the projected period. The market growth of the region is attributed to the heavy natural resources of the chemicals in the region. Moreover, the region is expected to increase their production capacities in the future akin to increasing initiatives of development of petrochemical clusters in some areas of the region during the forecast period.

Countries such as Saudi Arabia and the UAE have high development investments, which further drive the petrochemical sales in the region. Moreover, huge oil and gas reserves are heavily contributing feedstock for petrochemicals in the current period.

For instance, In 2025, Borouge is planning to launch a share buyback program while increasing dividends. Also, the Borouge share gets attention and increases to AED 2.48 on the Abu Dhabi Security Exchange.

The ethylene segment held the dominating share of the petrochemical market in 2024. The wide application of several major industries is leading the segment growth in the current period. Moreover, it plays a major role in the production of petrochemicals such as ethylene oxide, polyethylene, and ethylene dichloride, which have been in high demand in the past years. Also, the increasing need for plastics has contributed to the ethylene segment potential in recent years, as ethylene polyethylene is commonly used in all plastics nowadays.

Furthermore, the rising need for hygiene and healthcare products is contributing to the major share in the growth of the ethylene segment in recent years. The manufacturers are seen in heavy usage of the ethylene oxide in these healthcare products in the current period.

The methanol segment is expected to experience significant growth in the petrochemical market during the forecast period. Having characteristics like cost-effectiveness, vast applications in industries, and versatility is likely to drive segment growth forward in the coming years.

The expansion of the adhesive and construction materials industry can provide a major consumer base to the methanol manufacturer in the coming years, as methanol plays a major role in the development of formaldehyde, and formaldehyde is a crucial component of the development of materials such as adhesives and construction materials.

Moreover, the sudden surge of sustainability initiatives can lead to segment growth during the forecast period as the methanol known as the burning alternative fuel as the clean way.

Collaboration: In 2025, Aramco, Yasref, and Sinopec made a partnership with a signed venture framework agreement for the creation of a petrochemical complex in Saudi Arabia. This complex is fully integrated, with a daily goal of 4 million barrels of crude oil.

Product Launch: In 2025, the MRPL introduced its latest toluene product in India. Moreover, Toluene is expected to play a major role in specific industries such as paints, chemicals, defense, and pharmaceuticals, referred to as a versatile aromatic hydrocarbon.

Collaboration: In 2024, Aramco, SINOPE, and Fujian Petrochemical made a strategic collaboration for the development of a petrochemical and refining facility in China. Moreover, the refinery aims to make 16 million tons of crude oil annually and an ethylene production of 1.5 tons per year, as per the company’s claim.

By Product

April 2025

April 2025

April 2025

April 2025