April 2025

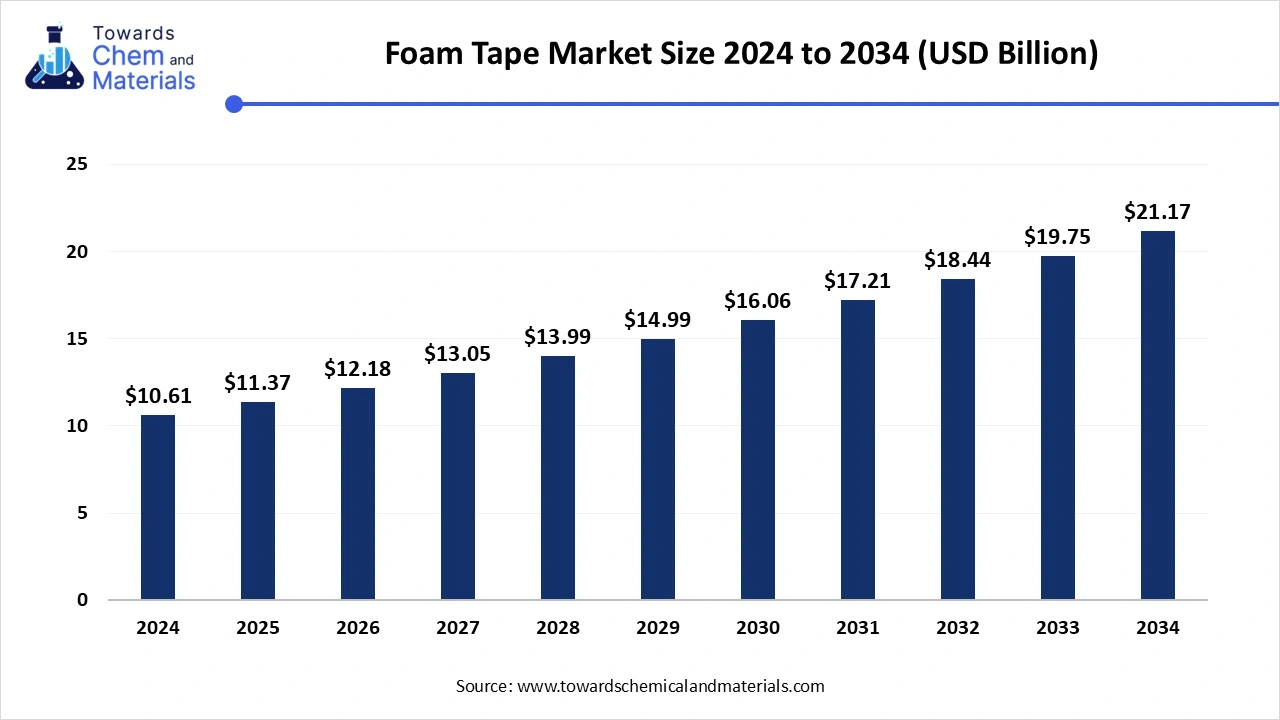

The global foam tape market size was valued at USD 10.61 billion in 2024 and is expected to hit around USD 21.17 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.15% over the forecast period 2025 to 2034. The growth in the electronic and semiconductor industry drives the growth of the market.

The foam tape market has witnessed steady growth in recent years. The wide applications in major industries such as electronics, construction, automotive, and packaging have contributed significantly to the growth of the market. The foam tapes offer strong adhesion, excellent vibration resistance, and greater durability, which can turn individuals' perspectives towards foam tapes in the current scenario. The foam tapes are seen in major usage in the construction industry with replacements of bolts, screws, and liquid adhesives in recent years.

The rise in the electronic and construction sector accelerates market expansion. Initiatives like energy-efficient building and sustainability, foam tapes are risen as the key solution for insulation purposes and soundproofing applications in the current period. Furthermore, the heavy need for high bonding strength in the electronic sectors is likely to boost foam tape sales in the future. Foam tapes have been seen in use extensively in the production of smartphones, wearable devices, and other electronic devices in recent periods.

| Report Metrics | Details |

| Market size in 2025 | USD 11.37 billion |

| Expected market size in 2034 | USD 21.17 billion |

| Growth Rate | CAGR of 7.15% from 2025 to 2034 |

| Base year estimation | 2024 |

| Forecast period | 2025-2034 |

| Segment covered | Adhesive type, technology,application,region |

| Dominant region | Europe |

| Key companies profile | 3M, Nitto Denko Corporation, HALCO Europe Ltd, tesa SE, Scapa, LINTEC Corporation, AVERY DENNISON CORPORATION, Intertape Polymer Group, LAMTEK Inc., Wuxi Canaan Adhesive Technology Co. Ltd. |

The expansion of electric vehicle adoption is projected to create significant opportunities for the foam tape market in the coming years. The foam tapes are increasingly used for battery insulation for thermal management in EV vehicles.Additionally, the increasing adaptation on the new and innovative material in automotive manufacturing and the manufacturers can create partnerships with the EV vehicle brands to gain attraction and the leading popularity of their foam tapes during the coming years.

The competition from the alternative bonding solution is likely to hinder market growth during the anticipated period. Traditional alternatives such as welding, liquid adhesives, and mechanical fasteners are increasingly consumed by some industries for their perceived durability and reliability. Though, the availability of the alternative products with enhanced properties restraint the growth of the market.

The high-end automotive sector, rapid industrial expansion, and need for advanced construction materials are leading the market growth in the region. Multinational foam tape manufacturing companies' massive production units are increasingly using favorable government policies in the region, such as tax reductions and others. Furthermore, the expansion of the automotive industry has contributed to the growth of the foam tape industry in recent years. Countries like the United Kingdom, France, and Germany have been considered global leaders in automotive manufacturing in recent years.

The sudden rise in infrastructure projects such as green construction initiatives and energy-efficient building sites will lead the foam tapes market growth in the future. The heavy expansion of the automobile sector and electronic industries are going to create substantial growth expected for the region in the next decade. Moreover, the development of high-end foam tapes can be seen in the upcoming days in the region of having the advantage of advanced technology.

The United States is expected to rise as the key country for the foam tape market in the coming years. The expansion of the automotive sector and heavy adoption of electrical vehicles will lead the market growth during the forecast period. The establishment of major automotive brands such as General Motors, Ford, and Tesla are significantly contributing to the market by using foam tapes in their product line in the current period.

The acrylic segment led the foam tape market in 2024. Having superior versatility, properties, and wide applications, the acrylic segment gained popularity over the period. The acrylic adhesives have excellent adhesions and long-lasting durability, which can easily perform under different conditions such as moisture, UV exposure, and extreme temperatures. Thus, individuals are increasingly demanding acrylic adhesives for construction works in the current period.

The silicon segment is expected to have the fastest growth in the market during the forecast period. The silicon segment can have the ability to stand with multiple ranges of temperature and can handle extreme heat to most cold which makes it ideal and suitable solution for the industries such as aerospace and automotive in the coming years. moreover, the demand for silicon adhesives from the electronics and automotive sector observed in recent years. Silicon adhesives are increasingly used in the manufacturing of circuit boards, batteries, and sensor systems due to their greater thermal management properties.

The solvent-based segment held the dominating position in the foam tape market in 2024. Solvent-based technology can create strong bonding adhesions. Also, solvent-based adhesives include chemical solvent that help the adhesives compounds dissolve easily and make them an ideal solution for the applications. Also, solved based adhesives dry quickly as solvent evaporates and it depends upon application. Thus, these properties of solvent-based adhesives can maintain market growth of the segment in the future also.

The water-based segment expects the notable growth rate during the predicted timeframe. Having a lower impact on the environment as compared to other technology, the water-based segment is expected to gain substantial market share in the coming period. Moreover, favorable government rules and regulations can lead the market growth upward during the forecast period.

The automotive segment dominated the market with the largest share in 2024. The properties such as thermal management, vibration resistance, and electric insulations made foam tape an ideal solution for the different automotive applications. Furthermore, the expansion of EV vehicles is driving the segment growth, as foam tapes are increasingly used in battery-related adhesions. Additionally, the growing demand for the automotive demand from the developing countries and expansion of the automotive manufacturing units is accelerating the demand for the market in the automotive sector.

The electronic segment expects significant growth in the market during the forecast period. The trend towards advanced wearables also plays a major role in the segment expansion in the future akin to the increased demand for foam tapes in the current period for the manufacturing of these devices. The foam tapes allow excellent bonding properties without reducing strength and flexibility.

April 2025

April 2025

April 2025

April 2025