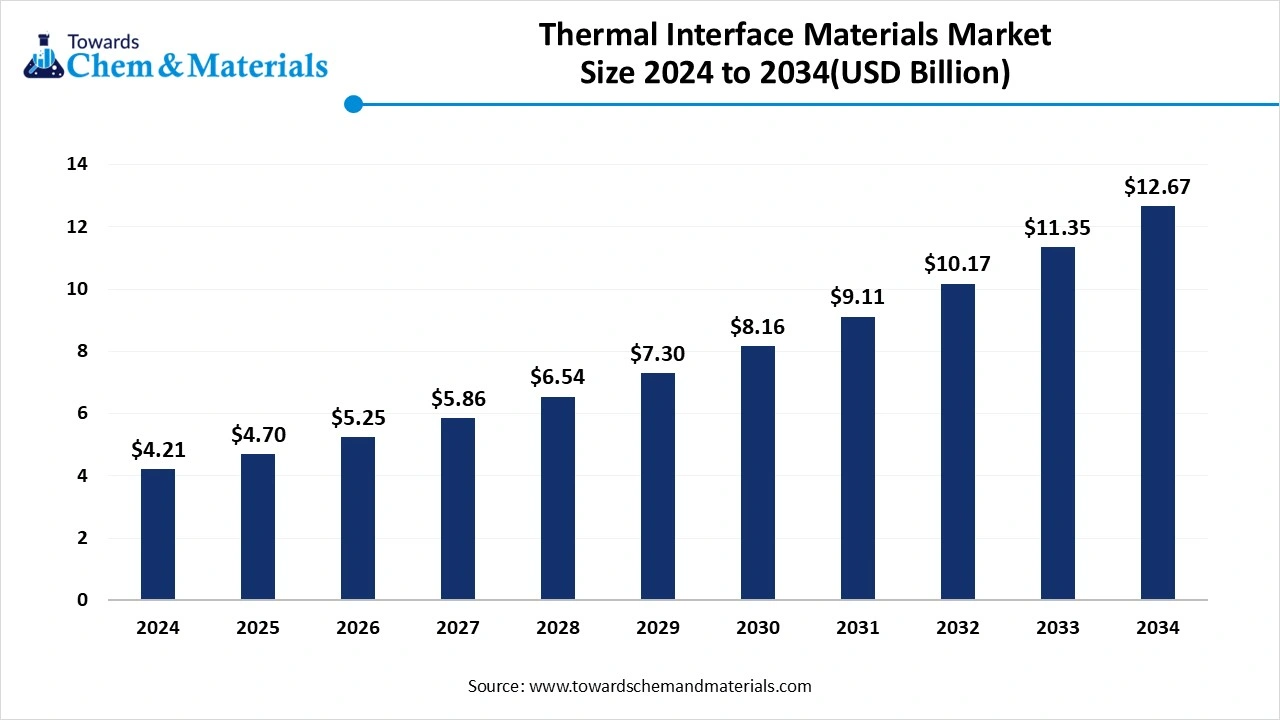

The thermal interface materials market size is calculated at USD 4.21 billion in 2024, grew to USD 4.70 billion in 2025, and is projected to reach around USD 12.67 billion by 2034. The market is expanding at a CAGR of 11.65% between 2025 and 2034.The growing demand for electronic devices like laptops, smartphones, computers, and many more, and the rising demand from automotive and industrial applications, drive the market growth.

Thermal interface materials are materials that ensure heat transfer between two or more solid surfaces in electronic devices. They are inserted between the heat-dissipating device and heat-producing devices. They are energy-efficient passive thermal management materials that help to prevent overheating of electronic devices and components. Thermal interface materials fill the gap between heatsinks and components to prevent damage to the device.

These materials are available in various forms, like thermal paste, thermal adhesives, phase-change materials, metal thermal interface materials, thermal tapes, and thermally conductive pads. Thermal paste is used in the electronics industry in thin applications, or materials can be contained. Thermal adhesives are used in semiconductor packages and inside thermal packages & they contain additional mechanical strength. Thermally conductive pads are made from silicon-like or silicon , materials and they are easy to apply.

Thermal tape doesn’t require curing time, and they are available in solid but flexible form. Phase change materials are used in building insulation, electronics, thermal energy storage, and textiles. Metal thermal interface materials have higher thermal conductivity and lower thermal interface resistance. Thermal interface materials extend component lifespan, improve device performance, and enhance thermal management.

The growing adoption of electronic devices like power electronics, computers, and smartphones increases demand for thermal interface materials to manage the heat generated by components such as power semiconductors, CPUs, and GPUs. Factors like the growing miniaturization of electronic devices, the rising adoption of 5G networks, rapid expansion in electric vehicles, and increasing awareness about renewable energy sources like solar energy and wind power are responsible for the growth of the thermal interface materials market.

The growing adoption of smartphones in consumers’ daily lives increases demand for thermal interface materials. Smartphones contain cameras, extensive processors, and other components that generate more heat within a small space. The ongoing trend of lighter, thinner, and compact-sized smartphones increases demand for heat dissipation. The growing demand for high-performance smartphones for video streaming and gaming increases the demand for thermal management to prevent overheating. The growing adoption of 5G networks increases heat generation and power consumption.

The wide expansion of Artificial Intelligence (AI) technology in devices has made tasks easy for consumers. Smartphones' various features, like multifunctionality, advanced technologies, and seamless connectivity, increase demand for thermal interface materials. The availability of entertainment, information & communication, the continuous expansion in smartphone technology, and the complexity of devices increase demand for thermal interface materials, which is a key driver for the thermal interface materials market.

| Report Attributes | Details |

| Market Size in 2025 | USD 4.70 Billion |

| Expected size in 2034 | USD 12.67 Billion |

| Growth Rate | CAGR of 11.65% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Henkel Corporation,Indium Corporation,3M,Fujipoly,Honeywell International Inc.,The Dow Chemical Company,Shin-Etsu,SIBELCO, Parker Hannifin,Momentive Performance Materials,Wakefield Thermal,Zalman Tech Co., Ltd,MG Chemicals,Bergquist Company,Parker Chomerics,Laird Technologies,Zalman Tech Corporation Ltd. |

Rapid growth in smart homes in various regions increases demand for smart appliances, sensors, controllers, and other electronic components directly fuels demand for thermal interface materials. Smart home relates to the thermal interface market for temperature management and energy efficiency. Functionalities like security systems and smart lighting in smart homes increase demand for thermal interface materials to avoid overheating.

The Internet of Things is a key technology for smart homes, and it ensures the efficiency and reliability of devices, which increases demand for thermal interface materials. Managing smart home networks requires smart hubs for controlling and processing devices, which fuels demand for thermal interface materials. The growing consumer demand for lightweight & thin devices and the rising adoption of environmentally friendly devices in smart homes are key opportunities for the thermal interface market growth.

With several benefits of advanced thermal materials in various industries, but high cost of advanced thermal materials may limit the market growth. The growing miniaturization of devices and the requirement for high-performance devices directly increases demand for advanced thermal materials.

The manufacturing process of super thermal conductivity materials is expensive. These advanced materials need boron nitride, carbon-based materials, and aluminium nitride, and they are expensive. The complex manufacturing process, like precise particle alignment, composite fabrication, and surface modification, increases the production cost. Furthermore, research and development of advanced materials and the need for specialized applications to manufacture materials hamper the thermal interface materials market growth.

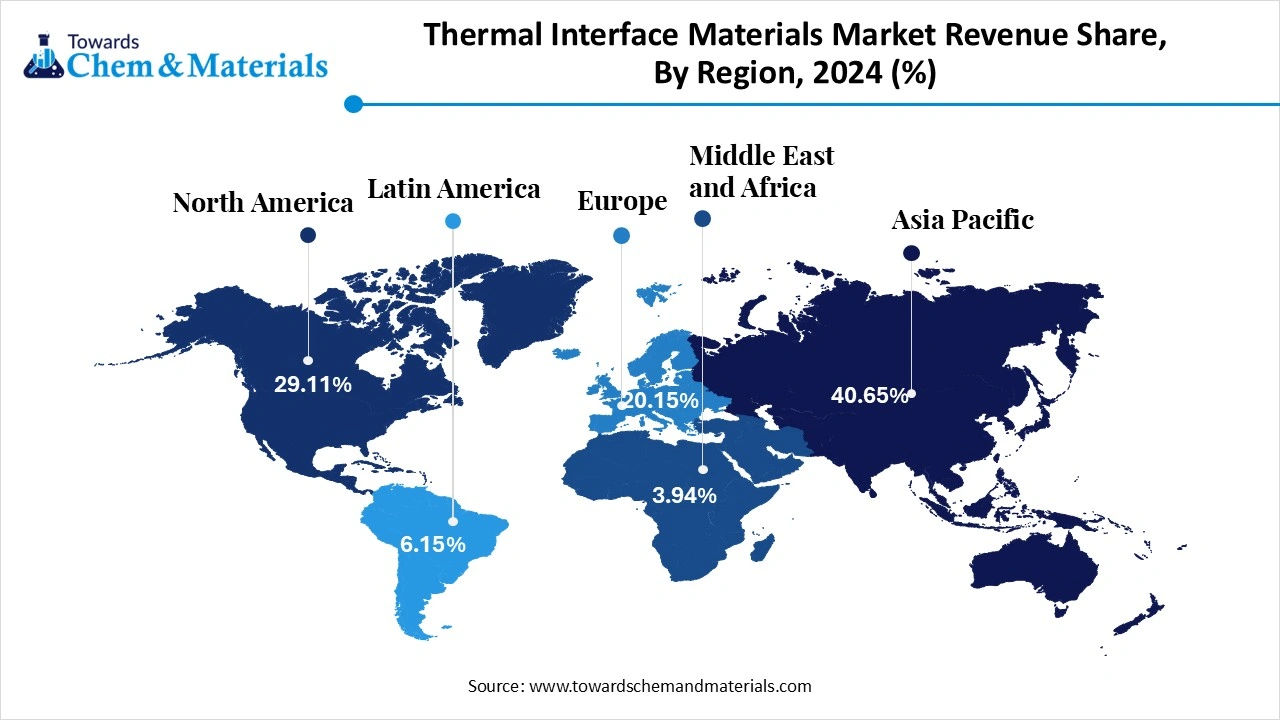

Asia Pacific dominated the thermal interface materials market in 2024. The growing electronics sector and the presence of major manufacturing hubs in automotive electronics, consumer electronics, and other technologies drive the growth of the market. The growing urbanization and rapid growth in infrastructure project development increase demand for machinery, which directly fuels demand for thermal interface materials.

The strong government support for domestic production and technological advancement in smartphones, automotive electronics, laptops, and computers drives the market growth in the region. Furthermore, the growing production and adoption of electric vehicles in these areas contribute to the market growth.

China is observed to be the largest contributor to the thermal interface materials market. The robust electronics production industry drives the growth of the market. The growing production of domestic DSPs and CPUs increases demand for advanced thermal interface materials. The growing industrialization increases demand for advanced technologies and automation, which fuels the market growth. Furthermore, the growing consumption and production of electric vehicles and the adoption of 5G technology in various sectors like healthcare, automotive & manufacturing further contribute to market growth.

India holds significant growth in the thermal interface materials market. The rapid expansion of consumer electronics and rising disposable incomes drive the market growth. The growing expansion of electric vehicles and ongoing innovations in electronic devices increase demand for thermal interface materials. The government initiative for domestic manufacturing increases domestic production of thermal interface materials.

North America is growing at the fastest rate in the market during the forecast period. The growing adoption of electric vehicles and the rapid growth in renewable energy sources like wind turbines and solar panels drive the growth of the market. The increasing demand for high-performance electronic devices such as gaming consoles, smartphones, and laptops fuels demand for thermal interface materials to avoid overheating.

The growing innovation in the electronics industry and the growing industrial applications require telecommunications, high-performance computing, and power generation, which fuels demand for thermal interface materials for effective thermal management. Additionally, the growing expansion of 5G networks, data centres, and cloud computing further drives the market growth.

The United States is a major contributor to the thermal interface materials market. Strong presence of electronics manufacturers increases demand for industrial electronics, consumer electronics, and telecommunications equipment, driving the growth of the market.

The growing innovation in high-performance computing and the miniaturization of electronic devices fuel demand for the market. The government focuses on sustainability and renewable resources, and increasing the automotive sector supports market growth. Furthermore, the presence of key market players contributes to market growth.

Europe is seen to grow at a notable rate in the thermal interface materials market. The growing utilization of laptops, computers, gaming consoles, smartphones, and other electronic devices drives the market growth.

The growing adoption of electric vehicles increases demand for thermal interface materials to ensure the thermal efficiency of electric motors, batteries, and other vehicle components. The presence of key companies like Henkel and Arctic Silver in the region supports market growth. Additionally, growing consumption in the industrial sector and government support in research and innovation drive the market growth.

The thermal greases and adhesives segment dominated the thermal interface materials market in 2024. The rising demand for miniaturized and electronic devices drives the growth of the market. The cost-effectiveness and ease of application increase demand for thermal greases and additives. They consist of excellent heat transfer abilities and avoid overheating. The growing demand from industrial applications like manufacturing, automotive, and aerospace fuels the market growth.

Thermal greases and additives fill microscopic gaps between components and maintain component stability. Furthermore, rising demand from GPUs, CPUs, and industrial machinery to prevent overheating and maintain smooth operation contributes to overall market growth.

The phase change materials segment is experiencing the fastest growth in the market during the forecast period. The growing demand from the construction sector for heating & cooling systems, temperature control, and solar energy drives the growth of the market. During a phase transition, phase change materials can hold and release a large amount of heat. They help to lower energy consumption and maintain a stable temperature in the defined range.

The growing need to lower greenhouse gas emissions increase demand for phase change materials. The strict rules and regulations for energy efficiency and lowering carbon emissions increase the adoption of phase change materials.

Additionally, growing demand from the packaging & electronics industry and technological advancement to improve performance & thermal efficiency drive the growth of the market.

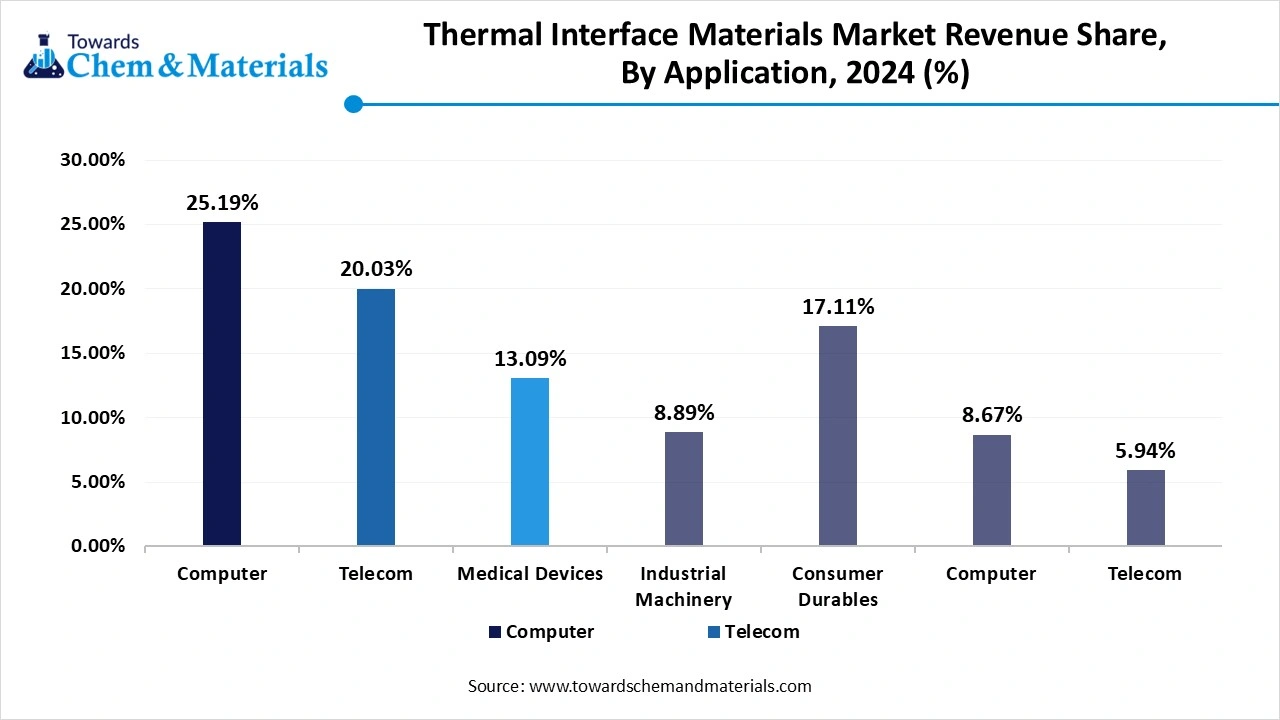

The computer segment dominated the thermal interface materials market in 2024. The rising demand for high-performance computing drives the market growth. The rising workstations, growing data centers, and increased demand for gaming computers increase the demand for thermal interface materials.

The growing utilization of electronic devices like laptops and desktops fuels demand for thermal interface materials to maintain optimal operating temperature and ensure efficient heat distribution.

The growing digitalisation trend and technological advancement in processing technology and memory modules drive the market growth. The growing content creation and rising adoption of AI in various sectors increase the demand for computers. Furthermore, growing remote work, hybrid work, and online learning contribute to market growth.

The telecom segment is expected to grow at the fastest rate in the market during the forecast period. The rapid growth in 5G technology and the growing demand for high-performance electronics drive the market growth. The ongoing trend of compact and smaller devices increases demand for thermal interface materials for effective thermal management.

The growing adoption of artificial intelligence, cloud computing, the internet of things, and edge computing in telecom drives the market growth. Rapid expansion in digital services and the availability of online streaming platforms increase demand for telecom devices. Additionally, specialized data plans, smartphone adoption, and strong government support fuel the growth of the market.

By Product

By Application

By Regional